Authors

Summary

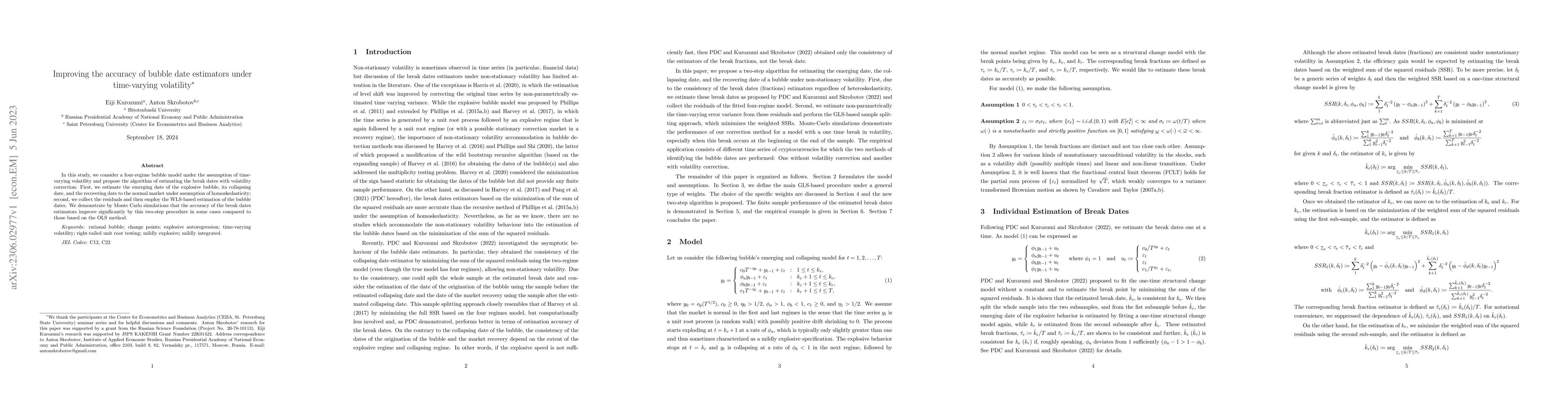

In this study, we consider a four-regime bubble model under the assumption of time-varying volatility and propose the algorithm of estimating the break dates with volatility correction: First, we estimate the emerging date of the explosive bubble, its collapsing date, and the recovering date to the normal market under assumption of homoskedasticity; second, we collect the residuals and then employ the WLS-based estimation of the bubble dates. We demonstrate by Monte Carlo simulations that the accuracy of the break dates estimators improve significantly by this two-step procedure in some cases compared to those based on the OLS method.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOn the asymptotic behavior of bubble date estimators

Anton Skrobotov, Eiji Kurozumi

Fractional Brownian markets with time-varying volatility and high-frequency data

Rituparna Sen, Ananya Lahiri

No citations found for this paper.

Comments (0)