Summary

In the evolving domain of cryptocurrency markets, accurate token valuation remains a critical aspect influencing investment decisions and policy development. Whilst the prevailing equation of exchange pricing model offers a quantitative valuation approach based on the interplay between token price, transaction volume, supply, and either velocity or holding time, it exhibits intrinsic shortcomings. Specifically, the model may not consistently delineate the relationship between average token velocity and holding time. This paper aims to refine this equation, enhancing the depth of insight into token valuation methodologies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

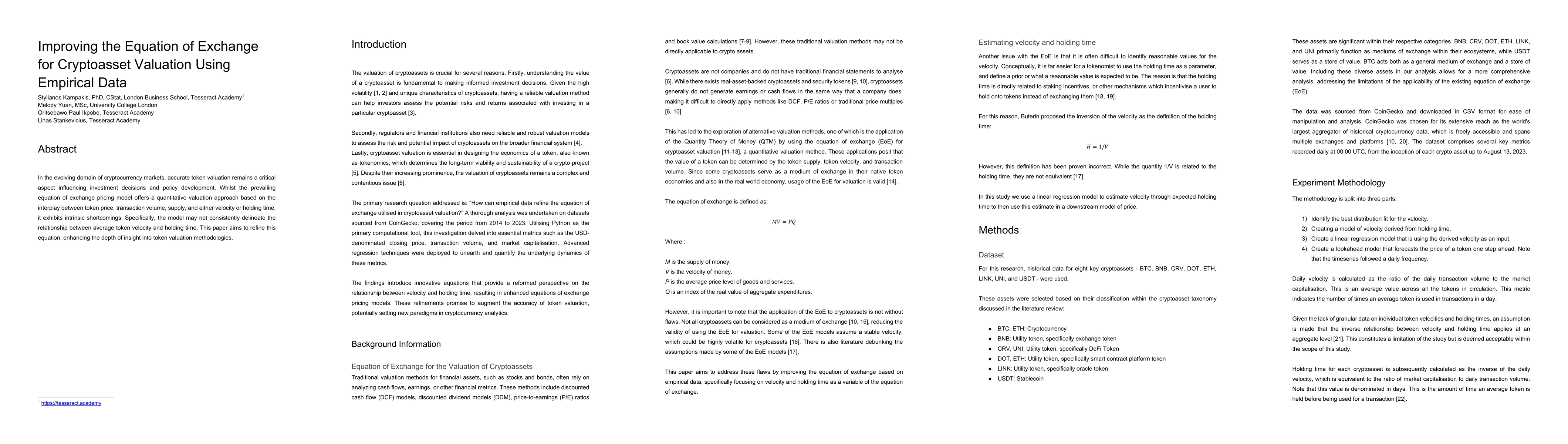

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersImproving Fairness for Data Valuation in Horizontal Federated Learning

Yong Zhang, Jian Pei, Zirui Zhou et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)