Summary

We demonstrate on a case study with two competing products at a bank how one can use a Hidden Markov Chain (HMC) to estimate missing information on a competitor's marketing activity. The idea is that given time series with sales volumes for products A and B and marketing expenditures for product A, as well as suitable predictors of sales for products A and B, we can infer at each point in time whether it is likely or not that marketing activities took place for product B. The method is successful in identifying the presence or absence of marketing activity for product B about 84% of the time. We allude to the issue of whether, if one can infer marketing activity about product B from knowledge of marketing activity for product A and of sales volumes of both products, the reverse might be possible and one might be able to impute marketing activity for product A from knowledge of that of product B. This leads to a concept of symmetric imputation of competing marketing activity. The exposition in this paper aims to be accessible and relevant to practitioners.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

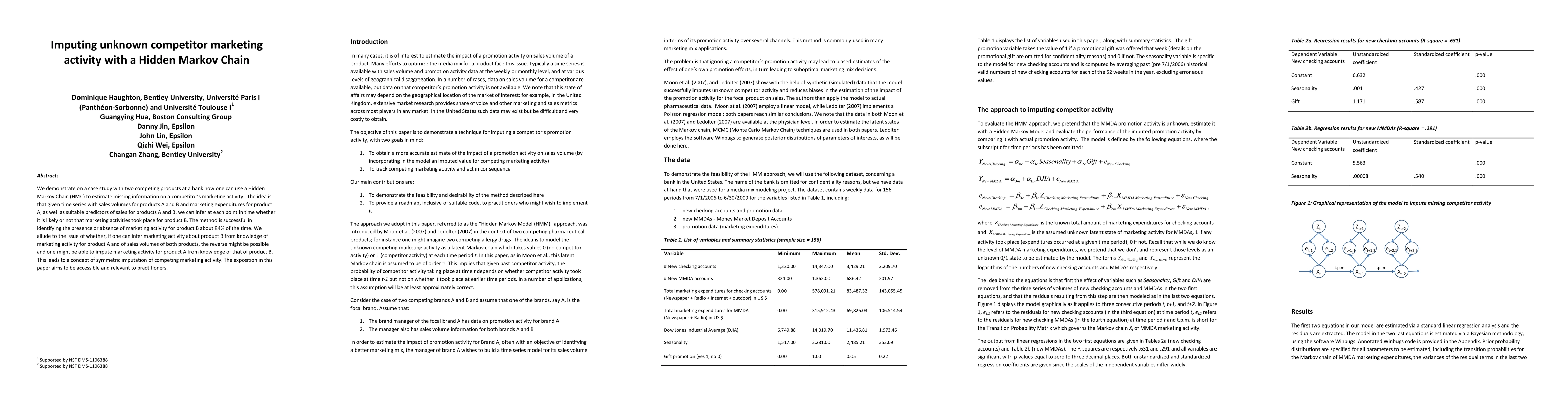

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)