Authors

Summary

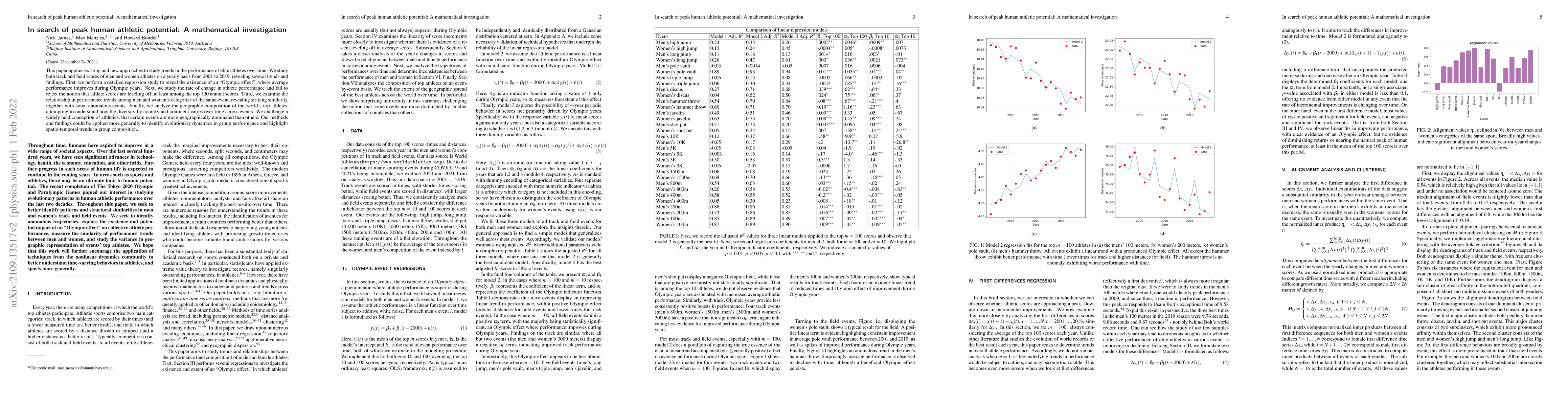

This paper applies existing and new approaches to study trends in the performance of elite athletes over time. We study both track and field scores of men and women athletes on a yearly basis from 2001 to 2019, revealing several trends and findings. First, we perform a detailed regression study to reveal the existence of an "Olympic effect", where average performance improves during Olympic years. Next, we study the rate of change in athlete performance and fail to reject the notion that athlete scores are leveling off, at least among the top 100 annual scores. Third, we examine the relationship in performance trends among men and women's categories of the same event, revealing striking similarity, together with some anomalous events. Finally, we analyze the geographic composition of the world's top athletes, attempting to understand how the diversity by country and continent varies over time across events. We challenge a widely held conception of athletics, that certain events are more geographically dominated than others. Our methods and findings could be applied more generally to identify evolutionary dynamics in group performance and highlight spatio-temporal trends in group composition.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMathematical Modelling and Optimisation of Athletic Performance: Tapering and Periodisation

Peter Taylor, Howard Bondell, David Ceddia

AthletePose3D: A Benchmark Dataset for 3D Human Pose Estimation and Kinematic Validation in Athletic Movements

Ryota Tanaka, Keisuke Fujii, Calvin Yeung et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)