Summary

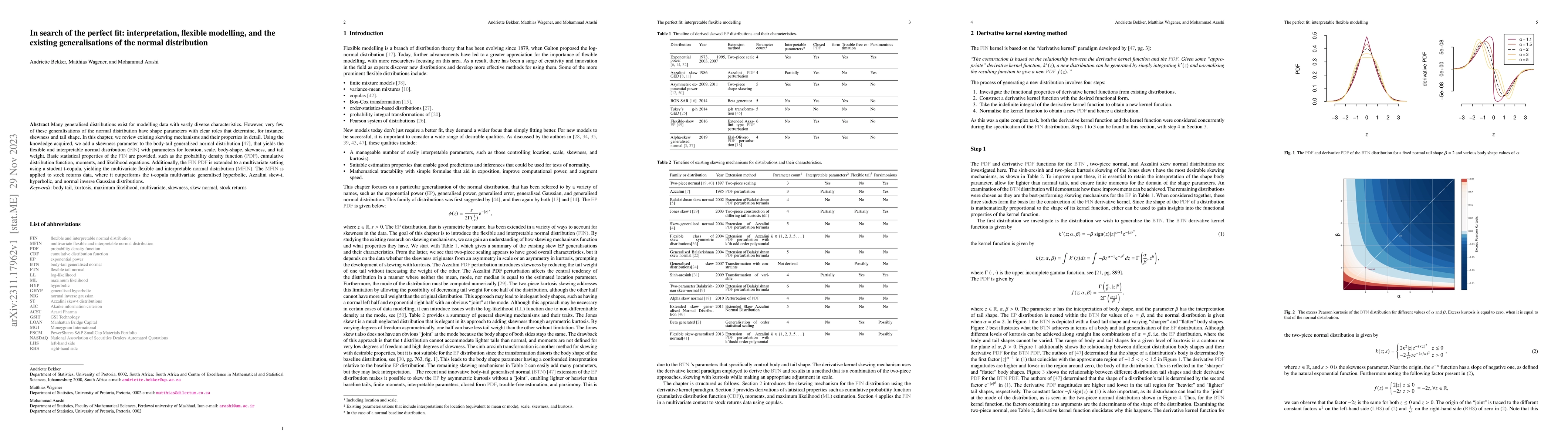

Many generalised distributions exist for modelling data with vastly diverse characteristics. However, very few of these generalisations of the normal distribution have shape parameters with clear roles that determine, for instance, skewness and tail shape. In this chapter, we review existing skewing mechanisms and their properties in detail. Using the knowledge acquired, we add a skewness parameter to the body-tail generalised normal distribution \cite{BTGN}, that yields the \ac{FIN} with parameters for location, scale, body-shape, skewness, and tail weight. Basic statistical properties of the \ac{FIN} are provided, such as the \ac{PDF}, cumulative distribution function, moments, and likelihood equations. Additionally, the \ac{FIN} \ac{PDF} is extended to a multivariate setting using a student t-copula, yielding the \ac{MFIN}. The \ac{MFIN} is applied to stock returns data, where it outperforms the t-copula multivariate generalised hyperbolic, Azzalini skew-t, hyperbolic, and normal inverse Gaussian distributions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

No citations found for this paper.

Comments (0)