Summary

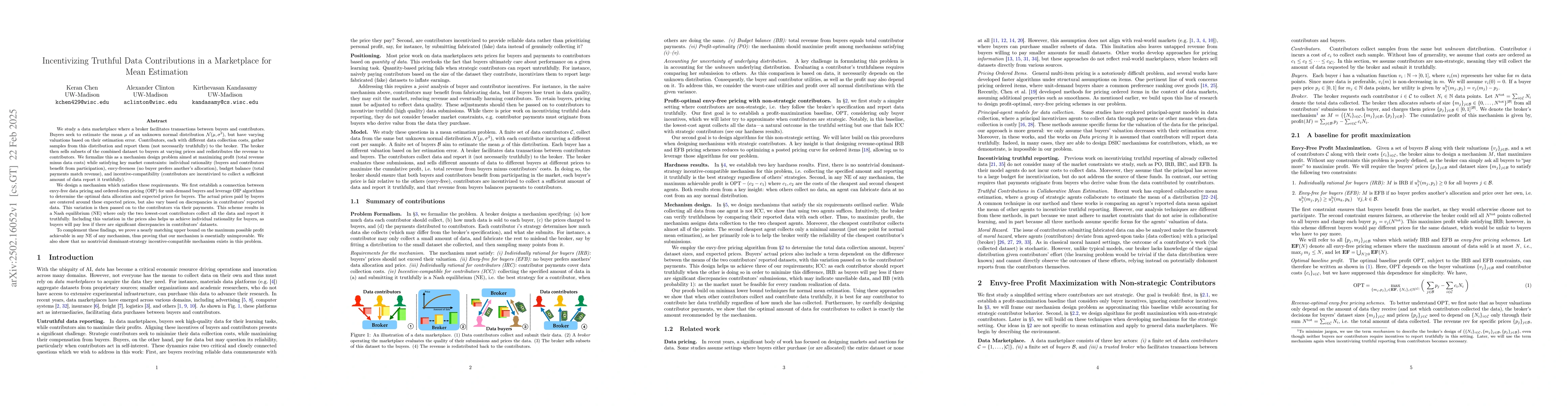

We study a data marketplace where a broker mediates transactions between buyers and contributors. Buyers estimate the mean mu of an unknown normal distribution N(mu, sigma^2), with valuations based on estimation error. Contributors, incurring different data collection costs, gather and report samples (not necessarily truthfully) to the broker, who sells subsets at varying prices and redistributes revenue. We model this as a mechanism design problem to maximize profit (revenue minus data costs) while ensuring individual rationality (participation benefits all), envy-freeness (no buyer prefers another allocation), budget balance (payments cover costs), and incentive compatibility (contributors truthfully report sufficient data). We design a mechanism which satisfies these requirements. We first establish a connection between envy-free data pricing and ordered-item pricing (OIP) for unit-demand buyers and leverage OIP algorithms to determine the optimal data allocation and expected prices for buyers. The actual prices paid by buyers are centered around these expected prices, but also vary based on discrepancies in contributors' reported data. This variation is then passed on to the contributors via their payments. This scheme results in a Nash equilibrium (NE) where only the two lowest-cost contributors collect all the data and report it truthfully. Including this variation in the prices also helps us achieve individual rationality for buyers, as buyers will pay less if there are significant discrepancies in contributors' datasets. To complement these findings, we prove a nearly matching upper bound on the maximum possible profit achievable in any NE of any mechanism, thus proving that our mechanism is essentially unimprovable. We also show that no nontrivial dominant-strategy incentive-compatible mechanism exists in this problem.

AI Key Findings

Generated Jun 11, 2025

Methodology

The paper models the data marketplace as a mechanism design problem, aiming to maximize profit while ensuring individual rationality, envy-freeness, budget balance, and incentive compatibility.

Key Results

- A mechanism is designed that satisfies all the requirements and results in a Nash equilibrium where only the two lowest-cost contributors collect and truthfully report all the data.

- A nearly matching upper bound on the maximum possible profit achievable in any Nash equilibrium of any mechanism is proven, indicating the mechanism's near-optimality.

- It is shown that no nontrivial dominant-strategy incentive-compatible mechanism exists in this problem.

Significance

This research is significant as it addresses the challenge of incentivizing truthful data contributions in a data marketplace, ensuring fairness and efficiency in data estimation processes.

Technical Contribution

The paper establishes a connection between envy-free data pricing and ordered-item pricing (OIP) for unit-demand buyers, leveraging OIP algorithms to determine the optimal data allocation and expected prices for buyers.

Novelty

The mechanism's design, which ensures a Nash equilibrium with truthful reporting from the two lowest-cost contributors, is a novel approach to incentivizing honesty in data marketplaces.

Limitations

- The mechanism assumes a simplified model of buyers valuing data based on estimation error and contributors incurring different data collection costs.

- The study does not account for potential external factors or complexities in real-world data marketplaces.

Future Work

- Extending the framework to learning tasks beyond mean estimation.

- Relaxing the assumption that the broker knows contributors' costs.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Cramér-von Mises Approach to Incentivizing Truthful Data Sharing

Alex Clinton, Yiding Chen, Xiaojin Zhu et al.

Data Overvaluation Attack and Truthful Data Valuation

Yang Cao, Shuyuan Zheng, Makoto Onizuka et al.

No citations found for this paper.

Comments (0)