Summary

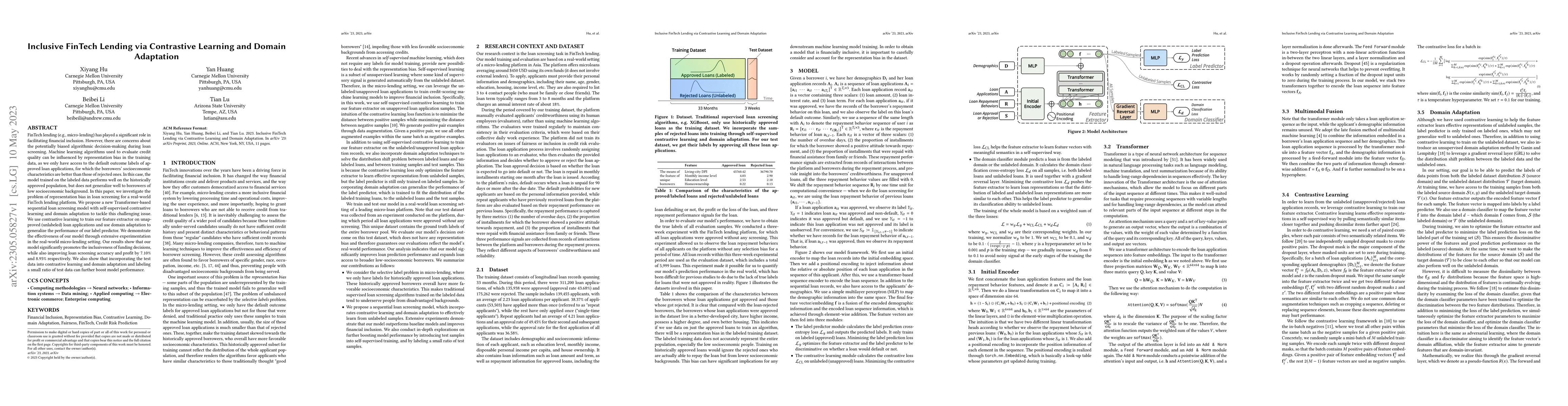

FinTech lending (e.g., micro-lending) has played a significant role in facilitating financial inclusion. It has reduced processing times and costs, enhanced the user experience, and made it possible for people to obtain loans who may not have qualified for credit from traditional lenders. However, there are concerns about the potentially biased algorithmic decision-making during loan screening. Machine learning algorithms used to evaluate credit quality can be influenced by representation bias in the training data, as we only have access to the default outcome labels of approved loan applications, for which the borrowers' socioeconomic characteristics are better than those of rejected ones. In this case, the model trained on the labeled data performs well on the historically approved population, but does not generalize well to borrowers of low socioeconomic background. In this paper, we investigate the problem of representation bias in loan screening for a real-world FinTech lending platform. We propose a new Transformer-based sequential loan screening model with self-supervised contrastive learning and domain adaptation to tackle this challenging issue. We use contrastive learning to train our feature extractor on unapproved (unlabeled) loan applications and use domain adaptation to generalize the performance of our label predictor. We demonstrate the effectiveness of our model through extensive experimentation in the real-world micro-lending setting. Our results show that our model significantly promotes the inclusiveness of funding decisions, while also improving loan screening accuracy and profit by 7.10% and 8.95%, respectively. We also show that incorporating the test data into contrastive learning and domain adaptation and labeling a small ratio of test data can further boost model performance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDomain Confused Contrastive Learning for Unsupervised Domain Adaptation

Wenya Wang, Sinno Jialin Pan, Quanyu Long et al.

Probabilistic Contrastive Learning for Domain Adaptation

Man Zhang, Yixin Zhang, Junjie Li et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)