Authors

Summary

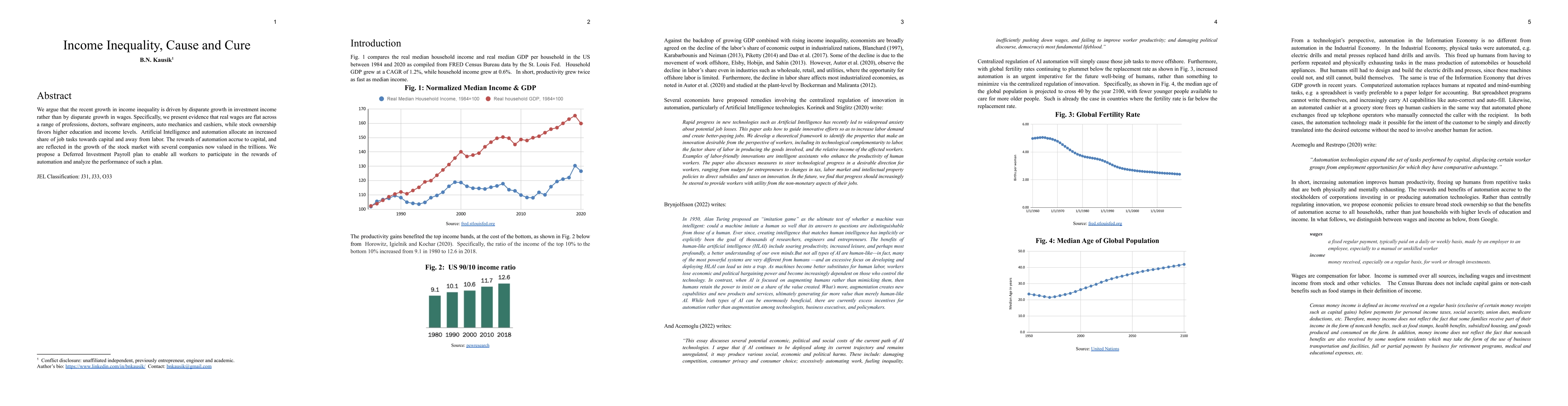

We argue that the recent growth in income inequality is driven by disparate growth in investment income rather than by disparate growth in wages. Specifically, we present evidence that real wages are flat across a range of professions, doctors, software engineers, auto mechanics and cashiers, while stock ownership favors higher education and income levels. Artificial Intelligence and automation allocate an increased share of job tasks towards capital and away from labor. The rewards of automation accrue to capital, and are reflected in the growth of the stock market with several companies now valued in the trillions. We propose a Deferred Investment Payroll plan to enable all workers to participate in the rewards of automation and analyze the performance of such a plan. JEL Classification: J31, J33, O33

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersInflation and income inequality: Does the level of income inequality matter?

Ram Sewak Dubey, Edmond Berisha, Orkideh Gharehgozli

Income inequality and the oil resource curse

Osiris Jorge Parcero, Elissaios Papyrakis

| Title | Authors | Year | Actions |

|---|

Comments (0)