Authors

Summary

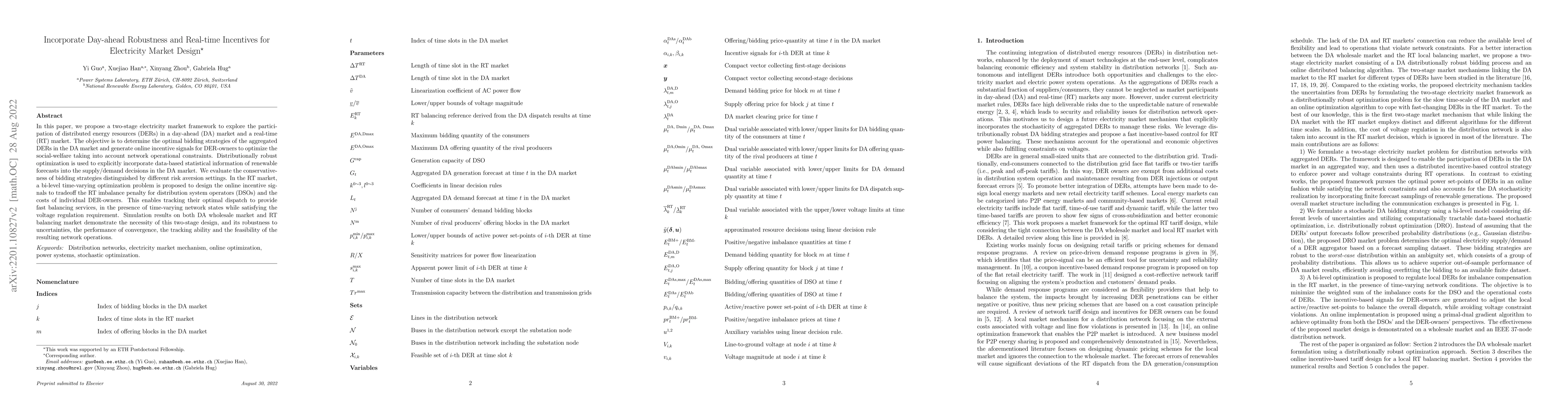

In this paper, we propose a two-stage electricity market framework to explore the participation of distributed energy resources (DERs) in a day-ahead (DA) market and a real-time (RT) market. The objective is to determine the optimal bidding strategies of the aggregated DERs in the DA market and generate online incentive signals for DER-owners to optimize the social welfare taking into account network operational constraints. Distributionally robust optimization is used to explicitly incorporate data-based statistical information of renewable forecasts into the supply/demand decisions in the DA market. We evaluate the conservativeness of bidding strategies distinguished by different risk aversion settings. In the RT market, a bi-level time-varying optimization problem is proposed to design the online incentive signals to tradeoff the RT imbalance penalty for distribution system operators (DSOs) and the costs of individual DER-owners. This enables tracking their optimal dispatch to provide fast balancing services, in the presence of time-varying network states while satisfying the voltage regulation requirement. Simulation results on both DA wholesale market and RT balancing market demonstrate the necessity of this two-stage design, and its robustness to uncertainties, the performance of convergence, the tracking ability, and the feasibility of the resulting network operations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLearning the Gap in the Day-Ahead and Real-Time Locational Marginal Prices in the Electricity Market

Economic incentives for capacity reductions on interconnectors in the day-ahead market

E. Ruben van Beesten, Daan Hulshof

| Title | Authors | Year | Actions |

|---|

Comments (0)