Summary

In this paper, we consider the basic problem of portfolio construction in financial engineering, and analyze how market-based and analytical approaches can be combined to obtain efficient portfolios. As a first step in our analysis, we model the asset returns as a random variable distributed according to a mixture of normal random variables. We then discuss how to construct portfolios that minimize the Conditional Value-at-Risk (CVaR) under this probabilistic model via a convex program. We also construct a second-order cone representable approximation of the CVaR under the mixture model, and demonstrate its theoretical and empirical accuracy. Furthermore, we incorporate the market equilibrium information into this procedure through the well-known Black-Litterman approach via an inverse optimization framework by utilizing the proposed approximation. Our computational experiments on a real dataset show that this approach with an emphasis on the market equilibrium typically yields less risky portfolios than a purely market-based portfolio while producing similar returns on average.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

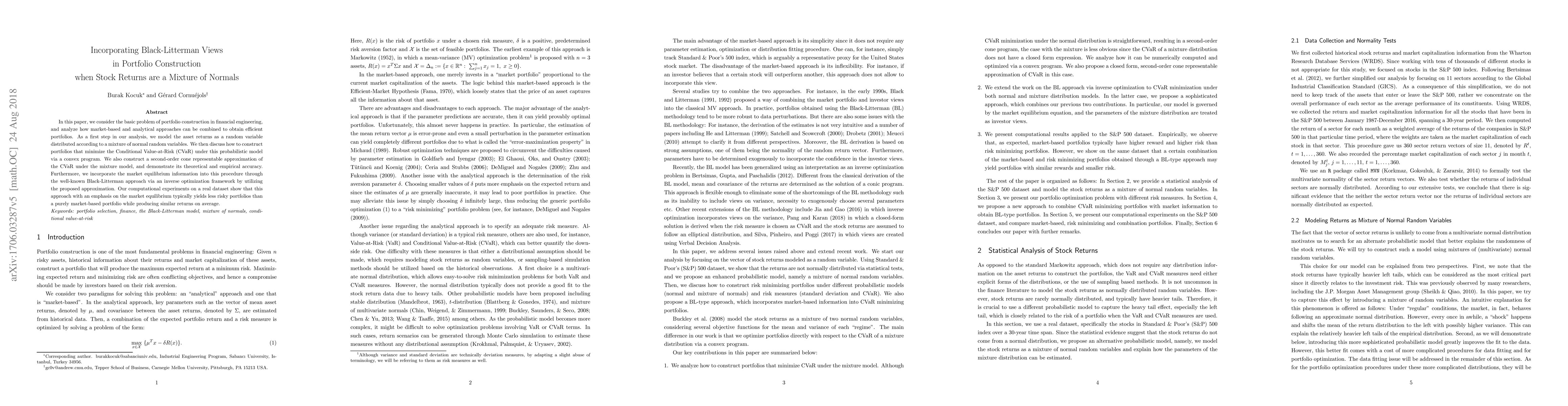

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersIntegrating LLM-Generated Views into Mean-Variance Optimization Using the Black-Litterman Model

Yongjae Lee, Yejin Kim, Youngbin Lee et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)