Authors

Summary

The econometric literature on treatment-effects typically takes functionals of outcome-distributions as `social welfare' and ignores program-impacts on unobserved utilities. We show how to incorporate aggregate utility within econometric program-evaluation and optimal treatment-targeting for a heterogenous population. In the practically important setting of discrete-choice, under unrestricted preference-heterogeneity and income-effects, the indirect-utility distribution becomes a closed-form functional of average demand. This enables nonparametric cost-benefit analysis of policy-interventions and their optimal targeting based on planners' redistributional preferences. For ordered/continuous choice, utility-distributions can be bounded. Our methods are illustrated with Indian survey-data on private-tuition, where income-paths of usage-maximizing subsidies differ significantly from welfare-maximizing ones.

AI Key Findings

Generated Sep 02, 2025

Methodology

The paper presents a method to incorporate social welfare in econometric program evaluation and treatment targeting for a heterogeneous population, utilizing closed-form functionals of average demand and nonparametric cost-benefit analysis.

Key Results

- The indirect-utility distribution can be expressed as a closed-form functional of average demand in discrete-choice settings with unrestricted preference heterogeneity and income effects.

- Nonparametric bounds on utility distributions can be established for ordered/continuous choice, enabling welfare analysis of policy interventions and their optimal targeting based on planners' redistributional preferences.

- The analysis is illustrated with Indian survey data on private tuition, showing significant differences between income-path subsidies and welfare-maximizing subsidies.

Significance

This research is significant as it addresses the gap in econometric literature by considering unobserved utilities and provides a framework for evaluating policy interventions and targeting subsidies optimally, with potential impact on social welfare policies.

Technical Contribution

The paper introduces a novel approach to express the marginal distribution of suitably normalized individual indirect utility as a closed-form functional of choice probabilities without functional-form assumptions on unobserved preference heterogeneity and income effects.

Novelty

The key novelty of this work lies in its closed-form functional expression for average weighted social welfare, allowing for nonparametric estimation and optimal targeting of interventions under fixed budget constraints, contrasting with traditional aggregate Hicksian welfare measures.

Limitations

- The method relies on assumptions such as unrestricted preference heterogeneity and income effects.

- Empirical illustration is limited to private tuition in India, which may not generalize to other contexts or goods.

Future Work

- Extending the method to other types of goods and contexts beyond private tuition in India.

- Investigating the robustness of findings under alternative assumptions and specifications.

Paper Details

PDF Preview

Key Terms

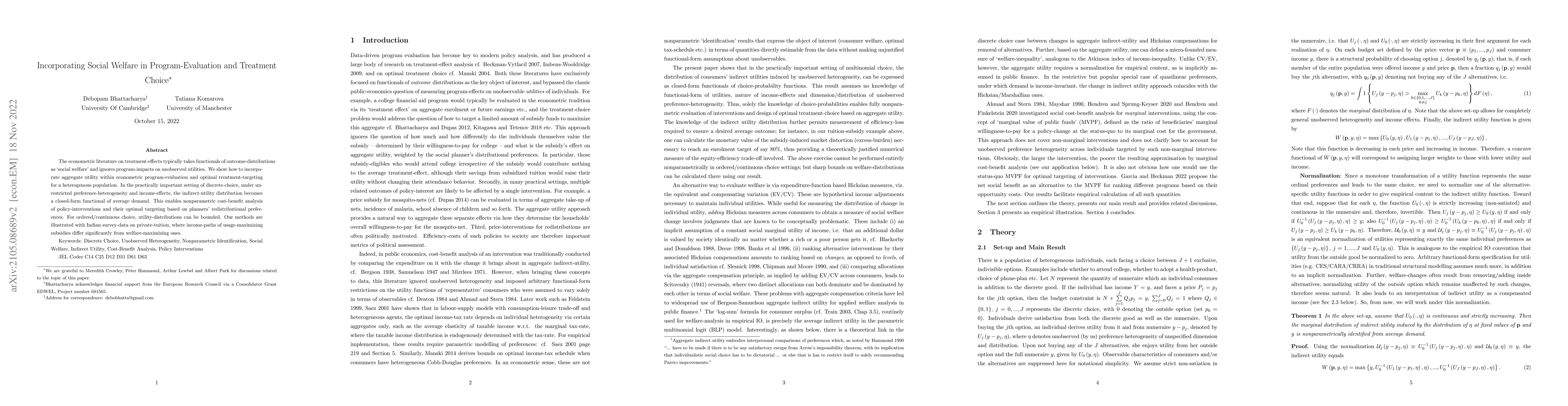

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersUtilitarian Social Choice and Distributional Welfare Analysis

Federico Echenique, Quitzé Valenzuela-Stookey

Demand and Welfare Analysis in Discrete Choice Models with Social Interactions

Debopam Bhattacharya, Pascaline Dupas, Shin Kanaya

Stochastic Treatment Choice with Empirical Welfare Updating

Toru Kitagawa, Jeff Rowley, Hugo Lopez

| Title | Authors | Year | Actions |

|---|

Comments (0)