Authors

Summary

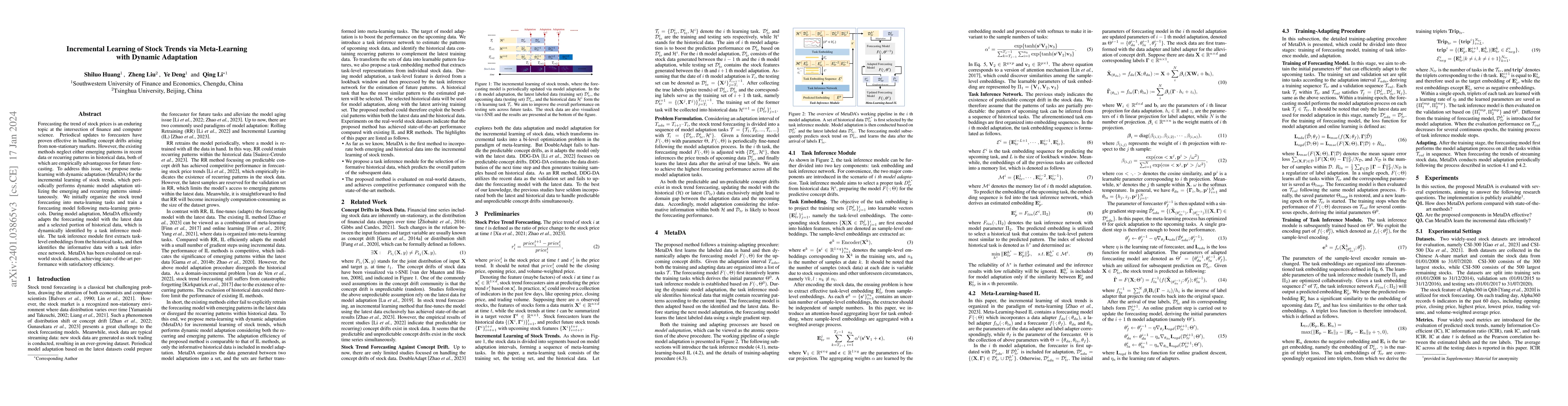

Forecasting the trend of stock prices is an enduring topic at the intersection of finance and computer science. Periodical updates to forecasters have proven effective in handling concept drifts arising from non-stationary markets. However, the existing methods neglect either emerging patterns in recent data or recurring patterns in historical data, both of which are empirically advantageous for future forecasting. To address this issue, we propose meta-learning with dynamic adaptation (MetaDA) for the incremental learning of stock trends, which periodically performs dynamic model adaptation utilizing the emerging and recurring patterns simultaneously. We initially organize the stock trend forecasting into meta-learning tasks and train a forecasting model following meta-learning protocols. During model adaptation, MetaDA efficiently adapts the forecasting model with the latest data and a selected portion of historical data, which is dynamically identified by a task inference module. The task inference module first extracts task-level embeddings from the historical tasks, and then identifies the informative data with a task inference network. MetaDA has been evaluated on real-world stock datasets, achieving state-of-the-art performance with satisfactory efficiency.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDoubleAdapt: A Meta-learning Approach to Incremental Learning for Stock Trend Forecasting

Yanyan Shen, Lifan Zhao, Shuming Kong

Meta-Stock: Task-Difficulty-Adaptive Meta-learning for Sub-new Stock Price Prediction

Qianli Ma, Zhen Liu, Linghao Wang et al.

No citations found for this paper.

Comments (0)