Authors

Summary

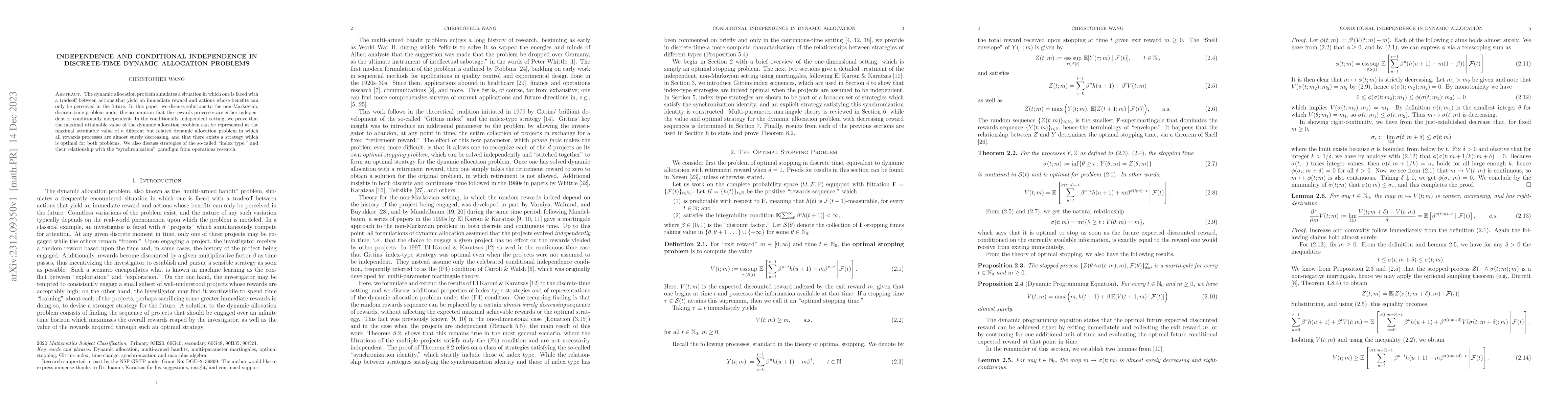

The dynamic allocation problem simulates a situation in which one is faced with a tradeoff between actions that yield an immediate reward and actions whose benefits can only be perceived in the future. In this paper, we discuss solutions to the non-Markovian, discrete-time problem under the assumption that the rewards processes are either independent or conditionally independent. In the conditionally independent setting, we prove that the maximal attainable value of the dynamic allocation problem can be represented as the maximal attainable value of a different but related dynamic allocation problem in which all rewards processes are almost surely decreasing, and that there exists a strategy which is optimal for both problems. We also discuss strategies of the so-called ``index type,'' and their relationship with the ``synchronization'' paradigm from operations research.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)