Summary

We study utility indifference prices and optimal purchasing quantities for a non-traded contingent claim in an incomplete semi-martingale market with vanishing hedging errors. We make connections with the theory of large deviations. We concentrate on sequences of semi-complete markets where in the $n^{th}$ market, the claim $B_n$ admits the decomposition $B_n = D_n+Y_n$. Here, $D_n$ is replicable by trading in the underlying assets $S_n$, but $Y_n$ is independent of $S_n$. Under broad conditions, we may assume that $Y_n$ vanishes in accordance with a large deviations principle as $n$ grows. In this setting, for an exponential investor, we identify the limit of the average indifference price $p_n(q_n)$, for $q_n$ units of $B_n$, as $n\rightarrow \infty$. We show that if $|q_n|\rightarrow\infty$, the limiting price typically differs from the price obtained by assuming bounded positions $\sup_n|q_n|<\infty$, and the difference is explicitly identifiable using large deviations theory. Furthermore, we show that optimal purchase quantities occur at the large deviations scaling, and hence large positions arise endogenously in this setting.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

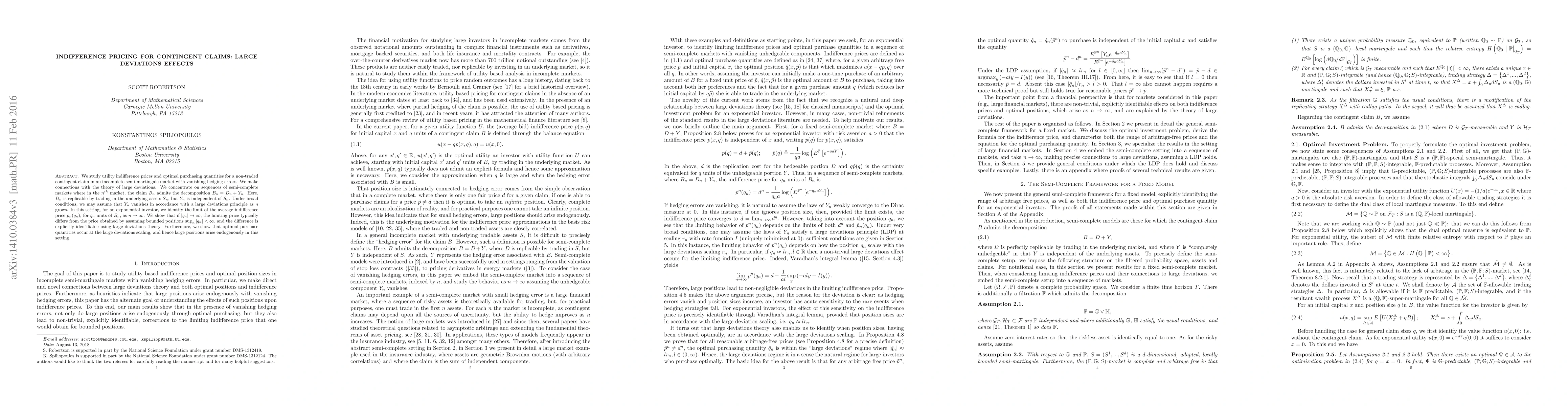

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRisk-indifference Pricing of American-style Contingent Claims

Stephan Sturm, Rohini Kumar, Frederick "Forrest" Miller et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)