Summary

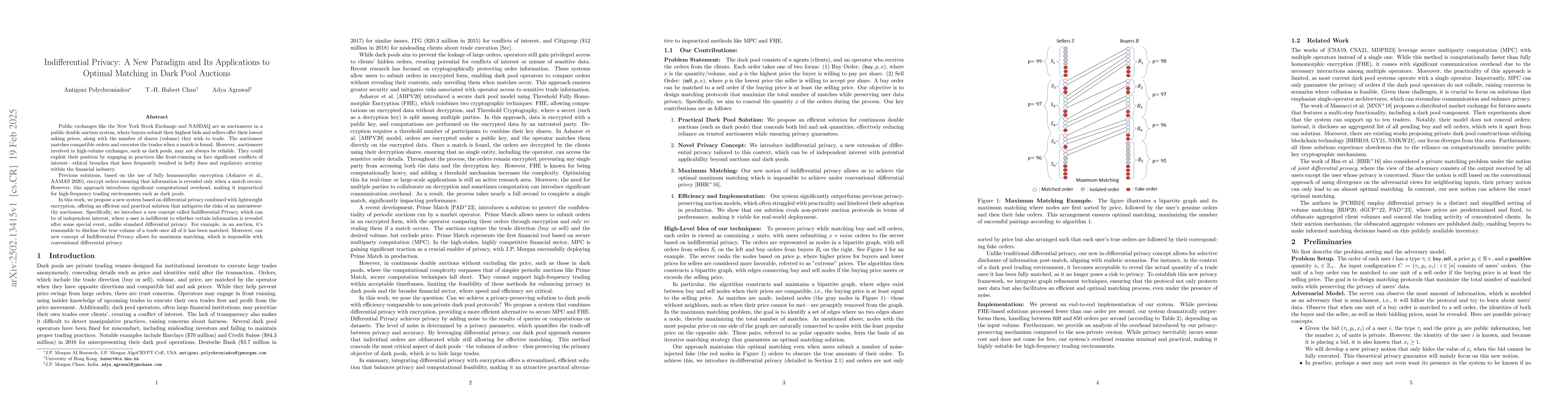

Public exchanges like the New York Stock Exchange and NASDAQ act as auctioneers in a public double auction system, where buyers submit their highest bids and sellers offer their lowest asking prices, along with the number of shares (volume) they wish to trade. The auctioneer matches compatible orders and executes the trades when a match is found. However, auctioneers involved in high-volume exchanges, such as dark pools, may not always be reliable. They could exploit their position by engaging in practices like front-running or face significant conflicts of interest, i.e., ethical breaches that have frequently resulted in hefty fines and regulatory scrutiny within the financial industry. Previous solutions, based on the use of fully homomorphic encryption (Asharov et al., AAMAS 2020), encrypt orders ensuring that information is revealed only when a match occurs. However, this approach introduces significant computational overhead, making it impractical for high-frequency trading environments such as dark pools. In this work, we propose a new system based on differential privacy combined with lightweight encryption, offering an efficient and practical solution that mitigates the risks of an untrustworthy auctioneer. Specifically, we introduce a new concept called Indifferential Privacy, which can be of independent interest, where a user is indifferent to whether certain information is revealed after some special event, unlike standard differential privacy. For example, in an auction, it's reasonable to disclose the true volume of a trade once all of it has been matched. Moreover, our new concept of Indifferential Privacy allows for maximum matching, which is impossible with conventional differential privacy.

AI Key Findings

Generated Jun 11, 2025

Methodology

The research introduces Indifferential Privacy (IDP), a new privacy paradigm combining differential privacy with lightweight encryption, designed for high-frequency trading environments like dark pools, addressing issues of untrustworthy auctioneers.

Key Results

- Proposes Indifferential Privacy (IDP), a relaxed notion of differential privacy suitable for high-volume trading environments.

- Demonstrates that IDP allows for maximum matching, unlike conventional differential privacy, which is crucial for dark pool auctions.

- Provides a privacy-preserving continuous double auction system that is efficient and practical for modern trading, addressing both performance and security concerns.

- Shows that the proposed protocol can be implemented using ideal functionality of cryptographic primitives, with straightforward extension to computational IDP.

Significance

This work is significant as it offers a practical solution to the privacy concerns in high-frequency trading environments, where previous methods like fully homomorphic encryption were impractical due to significant computational overhead.

Technical Contribution

The introduction of Indifferential Privacy (IDP) as a novel privacy concept that relaxes traditional differential privacy to accommodate maximum matching in auction settings, making it suitable for high-frequency trading.

Novelty

The research presents a fresh approach to privacy-preserving auctions by combining differential privacy with lightweight encryption, ensuring practicality in high-frequency trading environments like dark pools, which previous methods failed to achieve.

Limitations

- The paper does not extensively discuss real-world implementation challenges or potential adversarial attacks on the proposed system.

- The evaluation is conducted in simulated environments using ABIDES, and practical performance in real-world dark pool settings remains to be validated.

Future Work

- Investigate the protocol's resilience against more sophisticated adversarial models and attacks.

- Explore the scalability of the proposed system in handling even larger volumes of trades in real-world dark pools.

Paper Details

PDF Preview

Similar Papers

Found 4 papersMeasured Hockey-Stick Divergence and its Applications to Quantum Pufferfish Privacy

Vishal Singh, Mark M. Wilde, Theshani Nuradha

No citations found for this paper.

Comments (0)