Summary

We propose the use of indirect inference estimation to conduct inference in complex locally stationary models. We develop a local indirect inference algorithm and establish the asymptotic properties of the proposed estimator. Due to the nonparametric nature of locally stationary models, the resulting indirect inference estimator exhibits nonparametric rates of convergence. We validate our methodology with simulation studies in the confines of a locally stationary moving average model and a new locally stationary multiplicative stochastic volatility model. Using this indirect inference methodology and the new locally stationary volatility model, we obtain evidence of non-linear, time-varying volatility trends for monthly returns on several Fama-French portfolios.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

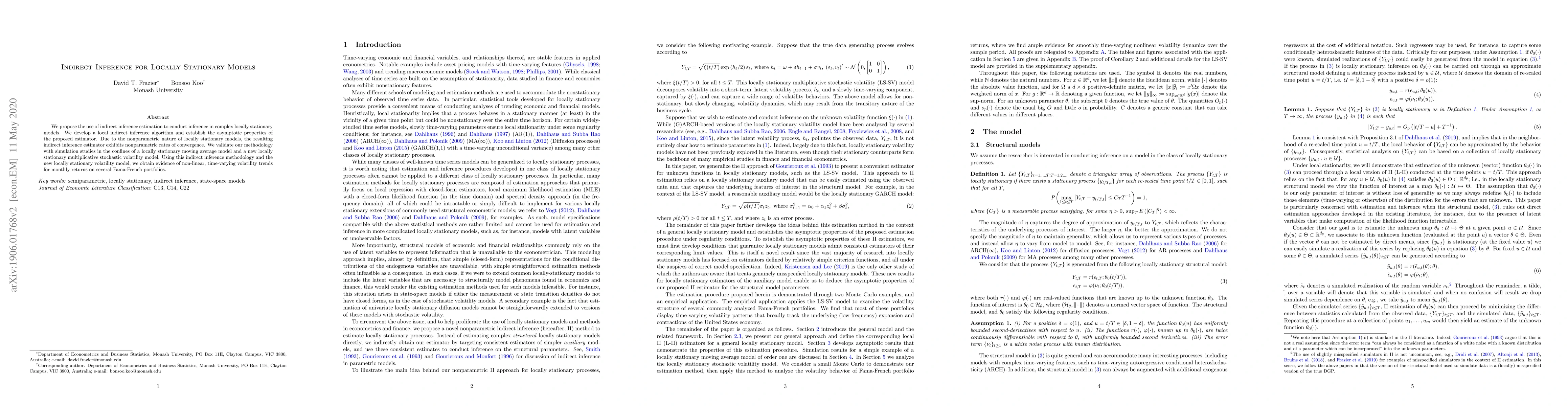

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)