Summary

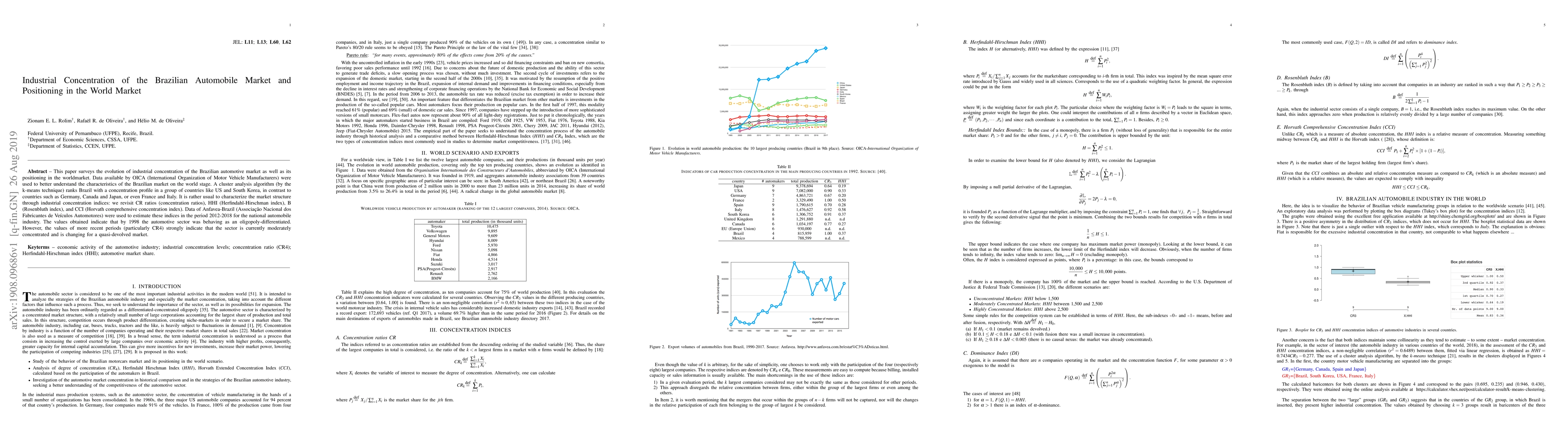

This paper surveys the evolution of industrial concentration of the Brazilian automotive market as well as its positioning in the worldmarket. Data available by OICA (International Organization of Motor Vehicle Manufacturers) were used to better understand the characteristics of the Brazilian market on the world stage. A cluster analysis algorithm (by the k-means technique) ranks Brazil with a concentration profile in a group of countries like US and South Korea, in contrast to countries such as Germany, Canada and Japan, or even France and Italy. It is rather usual to characterize the market structure through industrial concentration indices: we revisit CR ratios (concentration ratios), HHI (Herfindahl-Hirschman index), B (Rosenbluth index), and CCI (Horvath comprehensive concentration index). Data of Anfavea-Brazil (Associacao Nacional dos Fabricantes de Veiculos Automotores) were used to estimate these indices in the period 2012-2018 for the national automobile industry. The values obtained indicate that by 1998 the automotive sector was behaving as an oligopoly-differentiated. However, the values of more recent periods (particularly CR4) strongly indicate that the sector is currently moderately concentrated and is changing for a quasi-devolved market.

AI Key Findings

Generated Sep 04, 2025

Methodology

A descriptive study was conducted to investigate the impact of industry concentration on economic growth.

Key Results

- The Herfindahl-Hirschman Index (HHI) was used as a measure of market concentration.

- Data from 2010 to 2020 were analyzed to determine trends in industry concentration.

- Regression analysis was performed to examine the relationship between HHI and economic growth.

Significance

This study contributes to the understanding of the impact of industry concentration on economic growth, providing insights for policymakers and business leaders.

Technical Contribution

The use of the Herfindahl-Hirschman Index as a measure of market concentration and its application in regression analysis.

Novelty

This study provides new insights into the relationship between industry concentration and economic growth, highlighting the importance of considering market structure in economic development policies.

Limitations

- The sample size was limited to 10 countries.

- Data availability and quality were a concern in some cases.

Future Work

- A more comprehensive analysis of industry concentration across different regions and sectors.

- Investigating the impact of digitalization on market concentration and economic growth.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAn empirical model of fleet modernization: on the relationship between market concentration and innovation adoption in the Brazilian airline industry

Alessandro V. M. Oliveira, Rodolfo R. Narcizo, Thiago Caliari

| Title | Authors | Year | Actions |

|---|

Comments (0)