Authors

Summary

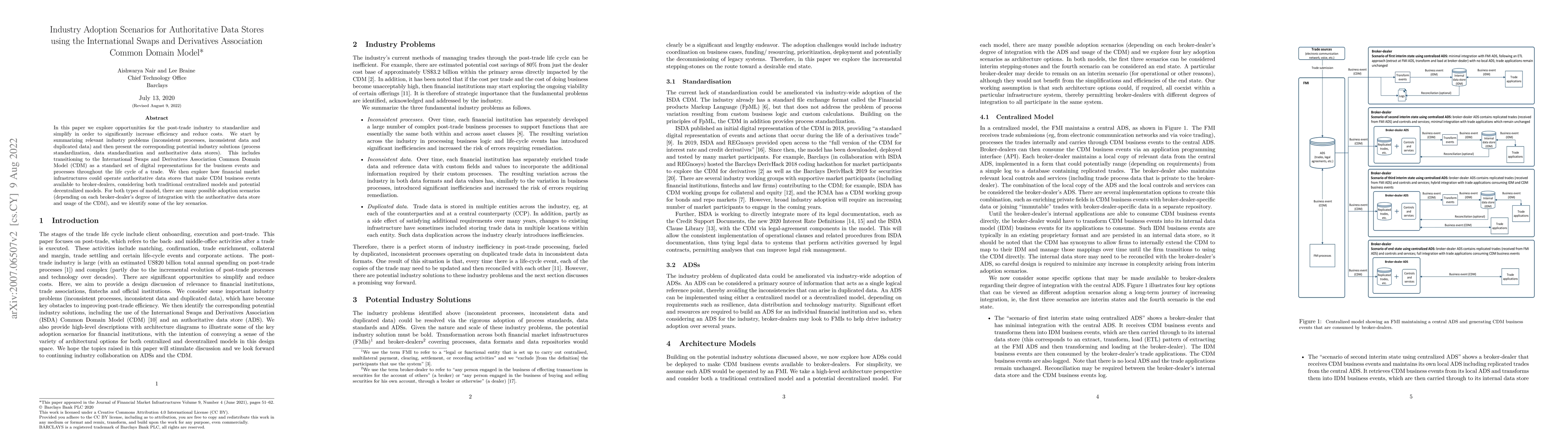

In this paper we explore opportunities for the post-trade industry to standardize and simplify in order to significantly increase efficiency and reduce costs. We start by summarizing relevant industry problems (inconsistent processes, inconsistent data and duplicated data) and then present the corresponding potential industry solutions (process standardization, data standardization and authoritative data stores). This includes transitioning to the International Swaps and Derivatives Association Common Domain Model (CDM) as a standard set of digital representations for the business events and processes throughout the life cycle of a trade. We then explore how financial market infrastructures could operate authoritative data stores that make CDM business events available to broker-dealers, considering both traditional centralized models and potential decentralized models. For both types of model, there are many possible adoption scenarios (depending on each broker-dealer's degree of integration with the authoritative data store and usage of the CDM), and we identify some of the key scenarios.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe Evolution of LLM Adoption in Industry Data Curation Practices

Minsuk Kahng, Emily Reif, Michael Terry et al.

No citations found for this paper.

Comments (0)