Summary

We study statistical inference on unit roots and cointegration for time series in a Hilbert space. We develop statistical inference on the number of common stochastic trends embedded in the time series, i.e., the dimension of the nonstationary subspace. We also consider tests of hypotheses on the nonstationary and stationary subspaces themselves. The Hilbert space can be of an arbitrarily large dimension, and our methods remain asymptotically valid even when the time series of interest takes values in a subspace of possibly unknown dimension. This has wide applicability in practice; for example, to the case of cointegrated vector time series that are either high-dimensional or of finite dimension, to high-dimensional factor model that includes a finite number of nonstationary factors, to cointegrated curve-valued (or function-valued) time series, and to nonstationary dynamic functional factor models. We include two empirical illustrations to the term structure of interest rates and labor market indices, respectively.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

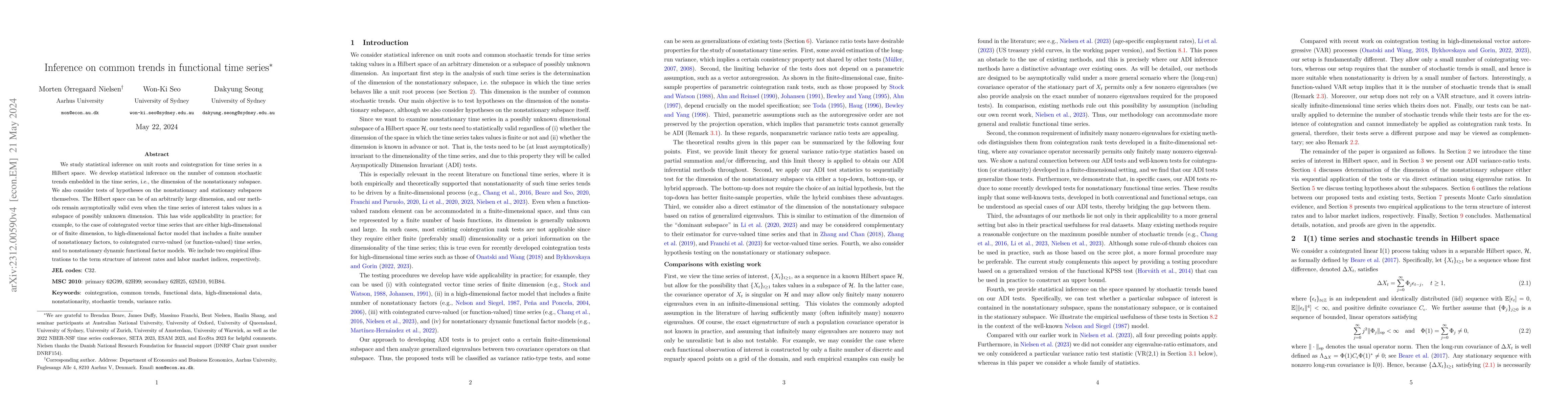

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLarge-Scale Curve Time Series with Common Stochastic Trends

Peter C. B. Phillips, Degui Li, Yu-Ning Li

Inference in matrix-valued time series with common stochastic trends and multifactor error structure

Rong Chen, Lorenzo Trapani, Simone Giannerini et al.

Inference on Common Trends in a Cointegrated Nonlinear SVAR

James A. Duffy, Xiyu Jiao

| Title | Authors | Year | Actions |

|---|

Comments (0)