Authors

Summary

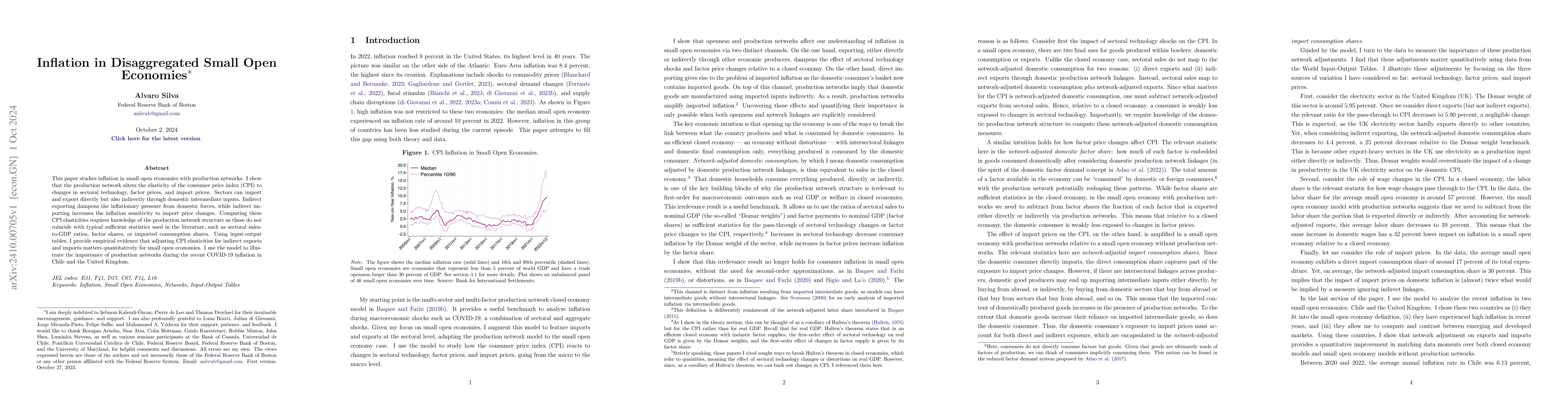

This paper studies inflation in small open economies with production networks. I show that the production network alters the elasticity of the consumer price index (CPI) to changes in sectoral technology, factor prices, and import prices. Sectors can import and export directly but also indirectly through domestic intermediate inputs. Indirect exporting dampens the inflationary pressure from domestic forces, while indirect importing increases the inflation sensitivity to import price changes. Computing these CPI elasticities requires knowledge of the production network structure as these do not coincide with typical sufficient statistics used in the literature, such as sectoral sales-to-GDP ratios, factor shares, or imported consumption shares. Using input-output tables, I provide empirical evidence that adjusting CPI elasticities for indirect exports and imports matters quantitatively for small open economies. I use the model to illustrate the importance of production networks during the recent COVID-19 inflation in Chile and the United Kingdom.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersIdentification of fiscal SVAR-IVs in small open economies

Henri Keränen, Sakari Lähdemäki

Zero-Inflated Stochastic Volatility Model for Disaggregated Inflation Data with Exact Zeros

Kaoru Irie, Geonhee Han

| Title | Authors | Year | Actions |

|---|

Comments (0)