Summary

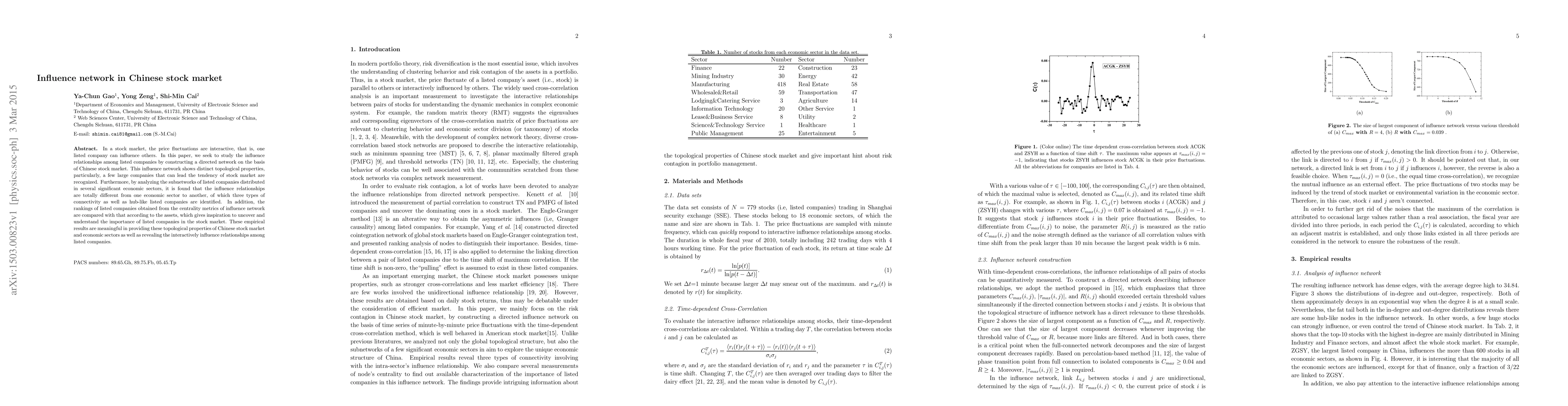

In a stock market, the price fluctuations are interactive, that is, one listed company can influence others. In this paper, we seek to study the influence relationships among listed companies by constructing a directed network on the basis of Chinese stock market. This influence network shows distinct topological properties, particularly, a few large companies that can lead the tendency of stock market are recognized. Furthermore, by analyzing the subnetworks of listed companies distributed in several significant economic sectors, it is found that the influence relationships are totally different from one economic sector to another, of which three types of connectivity as well as hub-like listed companies are identified. In addition, the rankings of listed companies obtained from the centrality metrics of influence network are compared with that according to the assets, which gives inspiration to uncover and understand the importance of listed companies in the stock market. These empirical results are meaningful in providing these topological properties of Chinese stock market and economic sectors as well as revealing the interactively influence relationships among listed companies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe Predictability of Stock Price: Empirical Study onTick Data in Chinese Stock Market

Tian Lan, Xingyu Xu, Sihai Zhang et al.

Optimal Market Making in the Chinese Stock Market: A Stochastic Control and Scenario Analysis

Shuaiqiang Liu, Shiqi Gong, Danny D. Sun

| Title | Authors | Year | Actions |

|---|

Comments (0)