Summary

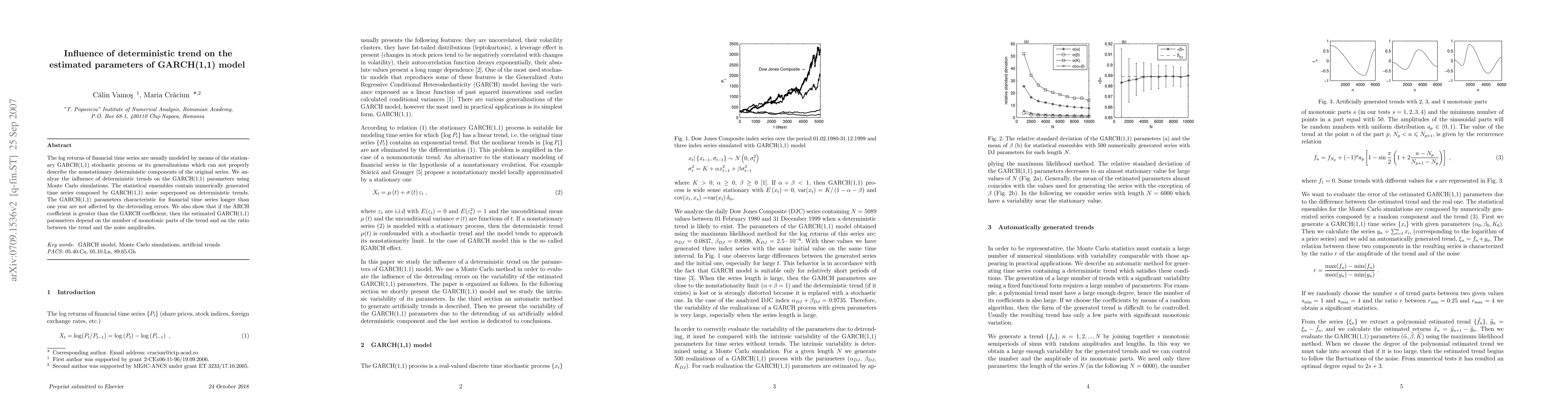

The log returns of financial time series are usually modeled by means of the stationary GARCH(1,1) stochastic process or its generalizations which can not properly describe the nonstationary deterministic components of the original series. We analyze the influence of deterministic trends on the GARCH(1,1) parameters using Monte Carlo simulations. The statistical ensembles contain numerically generated time series composed by GARCH(1,1) noise superposed on deterministic trends. The GARCH(1,1) parameters characteristic for financial time series longer than one year are not affected by the detrending errors. We also show that if the ARCH coefficient is greater than the GARCH coefficient, then the estimated GARCH(1,1) parameters depend on the number of monotonic parts of the trend and on the ratio between the trend and the noise amplitudes.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)