Authors

Summary

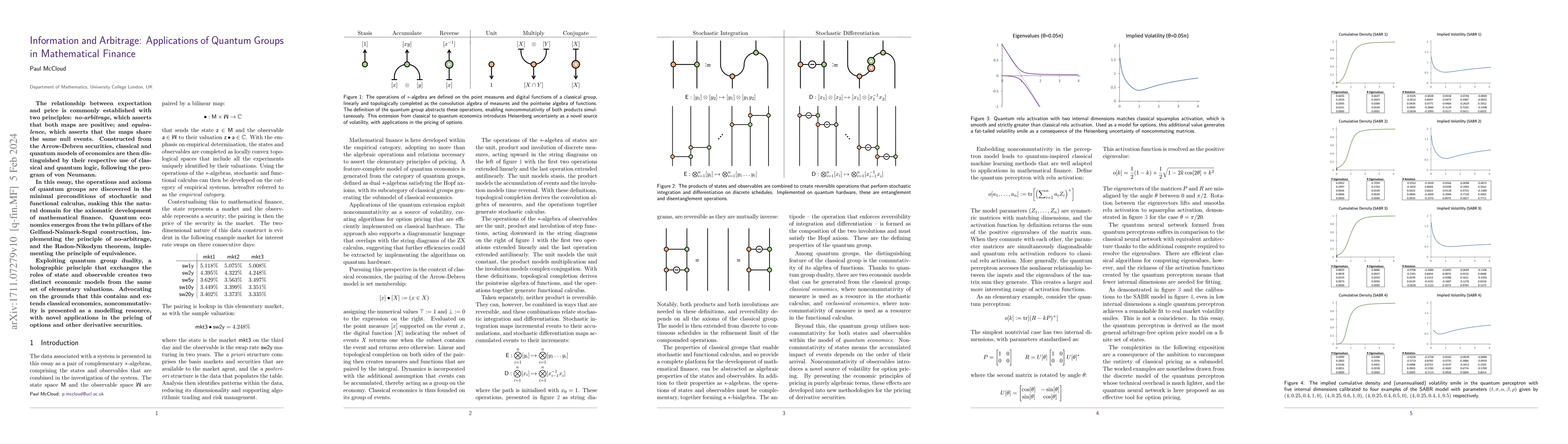

The relationship between expectation and price is commonly established with two principles: no-arbitrage, which asserts that both maps are positive; and equivalence, which asserts that the maps share the same null events. Constructed from the Arrow-Debreu securities, classical and quantum models of economics are then distinguished by their respective use of classical and quantum logic, following the program of von Neumann. In this essay, the operations and axioms of quantum groups are discovered in the minimal preconditions of stochastic and functional calculus, making this the natural domain for the axiomatic development of mathematical finance. Quantum economics emerges from the twin pillars of the Gelfand-Naimark-Segal construction, implementing the principle of no-arbitrage, and the Radon-Nikodym theorem, implementing the principle of equivalence. Exploiting quantum group duality, a holographic principle that exchanges the roles of state and observable creates two distinct economic models from the same set of elementary valuations. Advocating on the grounds that this contains and extends classical economics, noncommutativity is presented as a modelling resource, with novel applications in the pricing of options and other derivative securities.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersInsurance-Finance Arbitrage

Thorsten Schmidt, Philippe Artzner, Karl-Theodor Eisele

Robust asymptotic insurance-finance arbitrage

Katharina Oberpriller, Thorsten Schmidt, Moritz Ritter

Mutual Information Maximizing Quantum Generative Adversarial Network and Its Applications in Finance

Mingyu Lee, Junseo Lee, Kabgyun Jeong et al.

No citations found for this paper.

Comments (0)