Authors

Summary

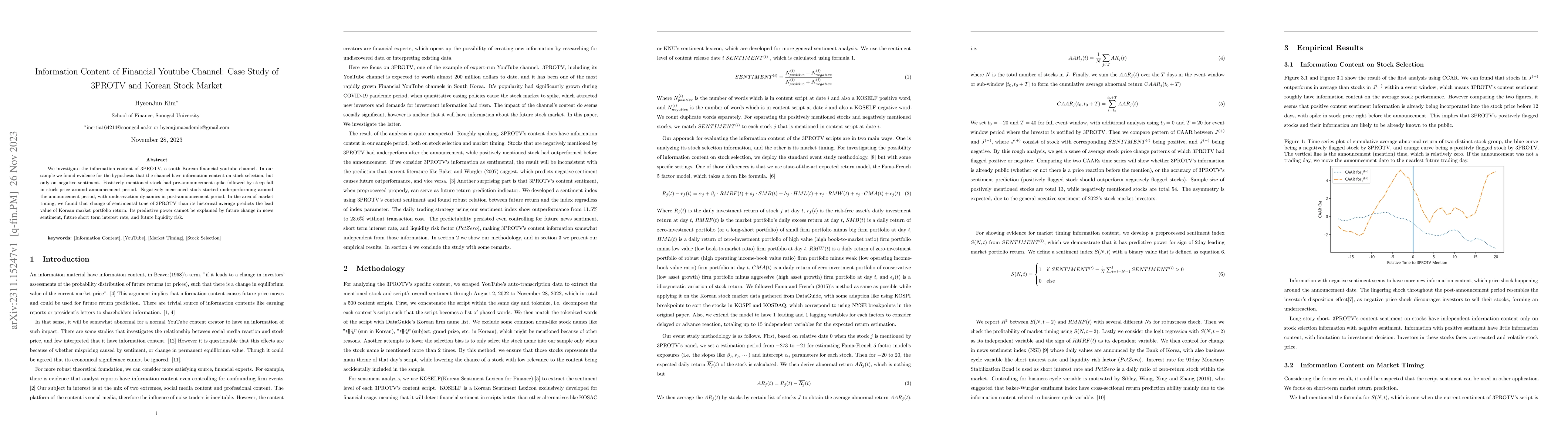

We investigate the information content of 3PROTV, a south Korean financial youtube channel. In our sample we found evidence for the hypothesis that the channel have information content on stock selection, but only on negative sentiment. Positively mentioned stock had pre-announcement spike followed by steep fall in stock price around announcement period. Negatively mentioned stock started underperforming around the announcement period, with underreaction dynamics in post-announcement period. In the area of market timing, we found that change of sentimental tone of 3PROTV than its historical average predicts the lead value of Korean market portfolio return. Its predictive power cannot be explained by future change in news sentiment, future short term interest rate, and future liquidity risk.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)