Authors

Summary

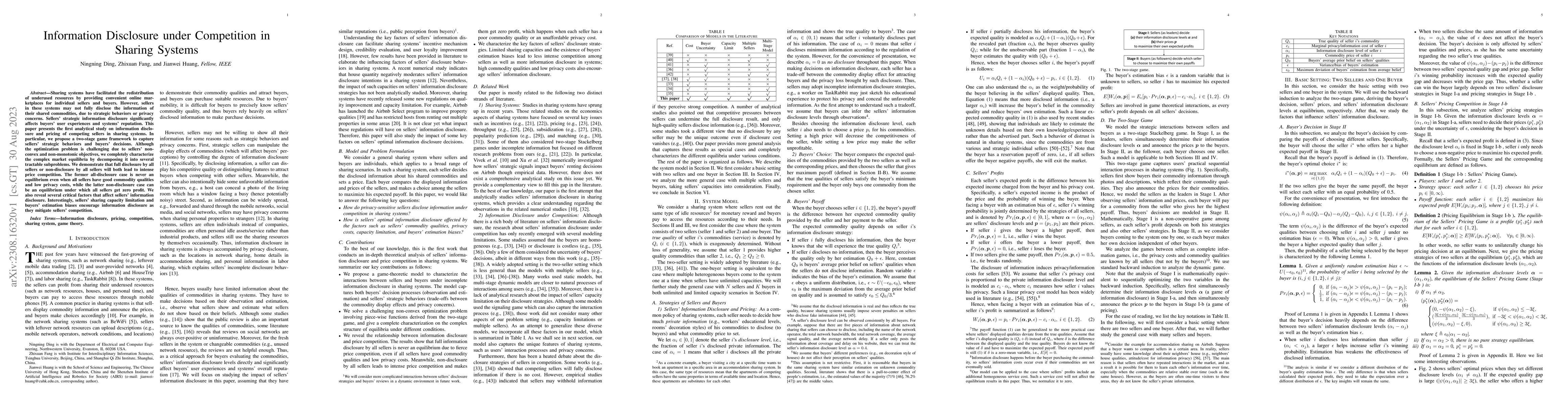

Sharing systems have facilitated the redistribution of underused resources by providing convenient online marketplaces for individual sellers and buyers. However, sellers in these systems may not fully disclose the information of their shared commodities, due to strategic behaviors or privacy concerns. Sellers' strategic information disclosure significantly affects buyers' user experiences and systems' reputation. This paper presents the first analytical study on information disclosure and pricing of competing sellers in sharing systems. In particular, we propose a two-stage game framework to capture sellers' strategic behaviors and buyers' decisions. Although the optimization problem is challenging due to sellers' non-convex and non-monotonic objectives, we completely characterize the complex market equilibria by decomposing it into several tractable subproblems. We demonstrate that full disclosure by all sellers or non-disclosure by all sellers will both lead to intense price competition. The former all-disclosure case is never an equilibrium even when all sellers have good commodity qualities and low privacy costs, while the latter non-disclosure case can be an equilibrium under which all sellers get zero profit. We also reveal several critical factors that affect sellers' information disclosure. Interestingly, sellers' sharing capacity limitation and buyers' estimation biases encourage information disclosure as they mitigate sellers' competition.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCompetitive Information Disclosure with Heterogeneous Consumer Search

Dongjin Hwang, Ilwoo Hwang

No citations found for this paper.

Comments (0)