Summary

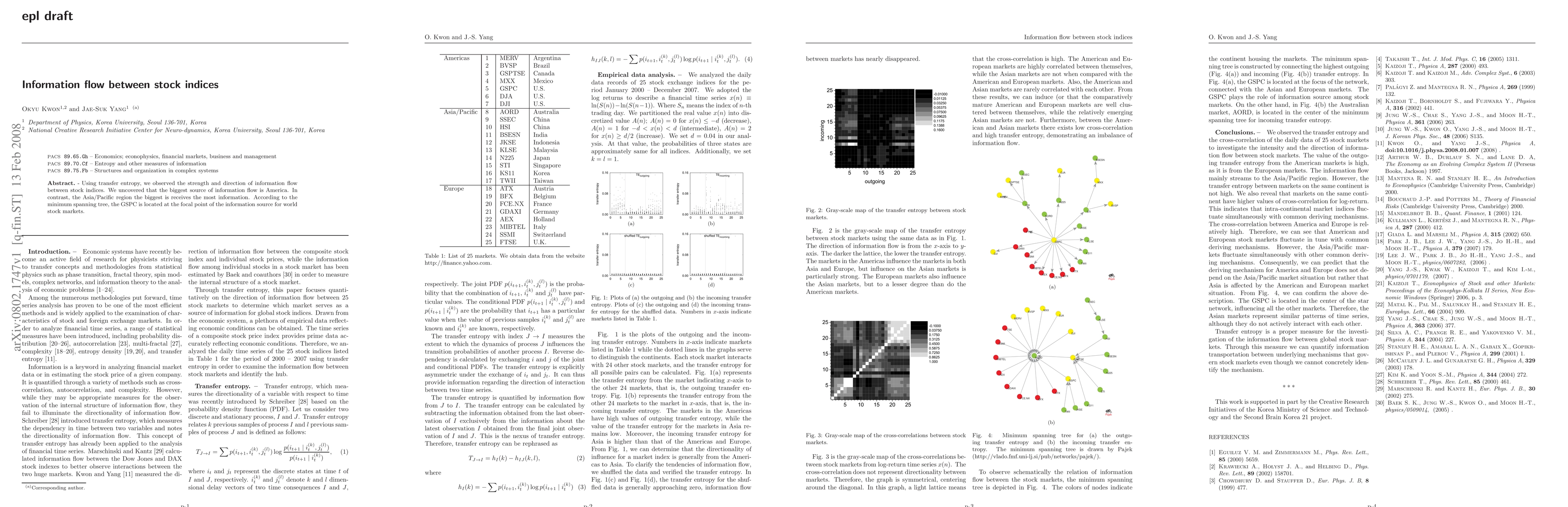

Using transfer entropy, we observed the strength and direction of information flow between stock indices. We uncovered that the biggest source of information flow is America. In contrast, the Asia/Pacific region the biggest is receives the most information. According to the minimum spanning tree, the GSPC is located at the focal point of the information source for world stock markets.

AI Key Findings

Generated Sep 04, 2025

Methodology

We used transfer entropy to measure information flow between global stock markets.

Key Results

- The American market had high outgoing transfer entropy

- The Asian/Pacific region received most of the incoming transfer entropy

- Intra-continental markets showed high cross-correlation for log-return

Significance

This research investigates information flow between global stock markets and its significance in finance.

Technical Contribution

We developed a method for measuring transfer entropy between global stock markets.

Novelty

This work provides a new approach to understanding information flow in financial systems

Limitations

- Limited to daily data only

- Assumes no external factors affect the system

Future Work

- Investigating seasonal effects on transfer entropy

- Examining the impact of economic indicators on information flow

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)