Summary

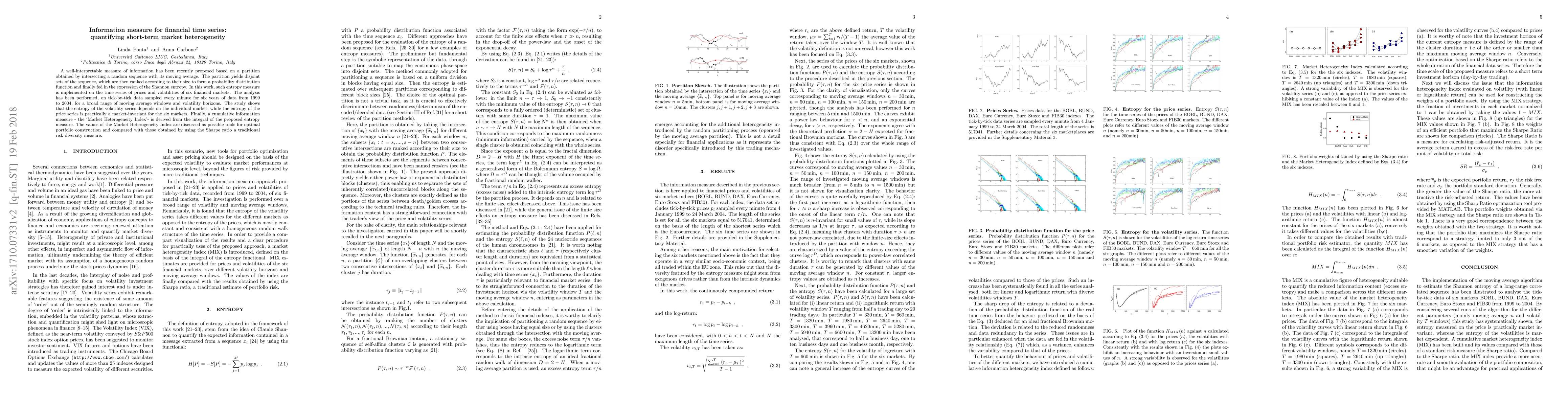

A well-interpretable measure of information has been recently proposed based on a partition obtained by intersecting a random sequence with its moving average. The partition yields disjoint sets of the sequence, which are then ranked according to their size to form a probability distribution function and finally fed in the expression of the Shannon entropy. In this work, such entropy measure is implemented on the time series of prices and volatilities of six financial markets. The analysis has been performed, on tick-by-tick data sampled every minute for six years of data from 1999 to 2004, for a broad range of moving average windows and volatility horizons. The study shows that the entropy of the volatility series depends on the individual market, while the entropy of the price series is practically a market-invariant for the six markets. Finally, a cumulative information measure - the `Market Heterogeneity Index'- is derived from the integral of the proposed entropy measure. The values of the Market Heterogeneity Index are discussed as possible tools for optimal portfolio construction and compared with those obtained by using the Sharpe ratio a traditional risk diversity measure.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)