Summary

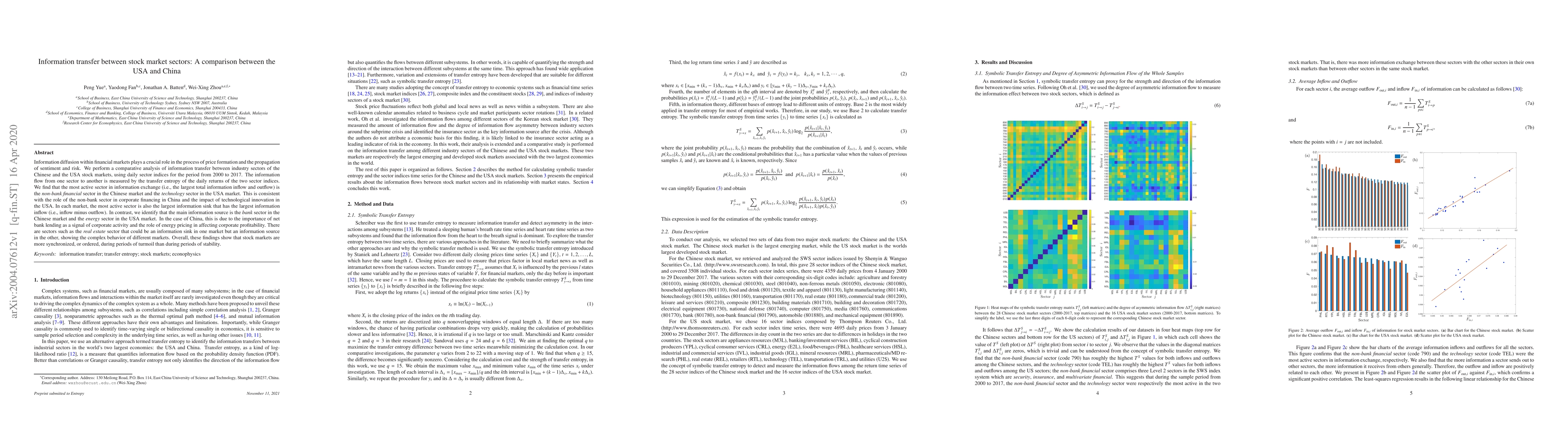

Information diffusion within financial markets plays a crucial role in the process of price formation and the propagation of sentiment and risk. We perform a comparative analysis of information transfer between industry sectors of the Chinese and the USA stock markets, using daily sector indices for the period from 2000 to 2017. The information flow from one sector to another is measured by the transfer entropy of the daily returns of the two sector indices. We find that the most active sector in information exchange (i.e., the largest total information inflow and outflow) is the {\textit{non-bank financial}} sector in the Chinese market and the {\textit{technology}} sector in the USA market. This is consistent with the role of the non-bank sector in corporate financing in China and the impact of technological innovation in the USA. In each market, the most active sector is also the largest information sink that has the largest information inflow (i.e., inflow minus outflow). In contrast, we identify that the main information source is the {\textit{bank}} sector in the Chinese market and the {\textit{energy}} sector in the USA market. In the case of China, this is due to the importance of net bank lending as a signal of corporate activity and the role of energy pricing in affecting corporate profitability. There are sectors such as the {\textit{real estate}} sector that could be an information sink in one market but an information source in the other, showing the complex behavior of different markets. Overall, these findings show that stock markets are more synchronized, or ordered, during periods of turmoil than during periods of stability.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)