Summary

A constrained informationally efficient market is defined to be one whose price process arises as the outcome of some equilibrium where agents face restrictions on trade. This paper investigates the case of short sale constraints, a setting which despite its simplicity, generates new insights. In particular, it is shown that short sale constrained informationally efficient markets always admit equivalent supermartingale measures and local martingale deflators, but not necessarily local martingale measures. And if in addition some local martingale deflator turns the price process into a true martingale, then the market is constrained informationally efficient. Examples are given to illustrate the subtle phenomena that can arise in the presence of short sale constraints, with particular attention to representative agent equilibria and the different notions of no arbitrage.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

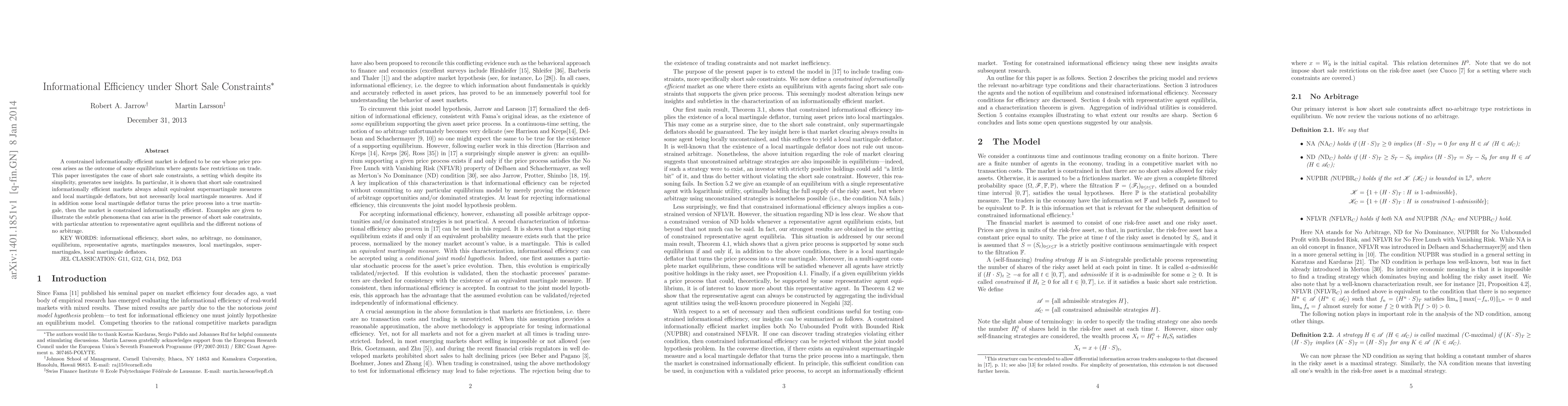

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)