Summary

We explore a model of the interaction between banks and outside investors in which the ability of banks to issue inside money (short-term liabilities believed to be convertible into currency at par) can generate a collapse in asset prices and widespread bank insolvency. The banks and investors share a common belief about the future value of certain long-term assets, but they have different objective functions; changes to this common belief result in portfolio adjustments and trade. Positive belief shocks induce banks to buy risky assets from investors, and the banks finance those purchases by issuing new short-term liabilities. Negative belief shocks induce banks to sell assets in order to reduce their chance of insolvency to a tolerably low level, and they supply more assets at lower prices, which can result in multiple market-clearing prices. A sufficiently severe negative shock causes the set of equilibrium prices to contract (in a manner given by a cusp catastrophe), causing prices to plummet discontinuously and banks to become insolvent. Successive positive and negative shocks of equal magnitude do not cancel; rather, a banking catastrophe can occur even if beliefs simply return to their initial state. Capital requirements can prevent crises by curtailing the expansion of balance sheets when beliefs become more optimistic, but they can also force larger price declines. Emergency asset price supports can be understood as attempts by a central bank to coordinate expectations on an equilibrium with solvency.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

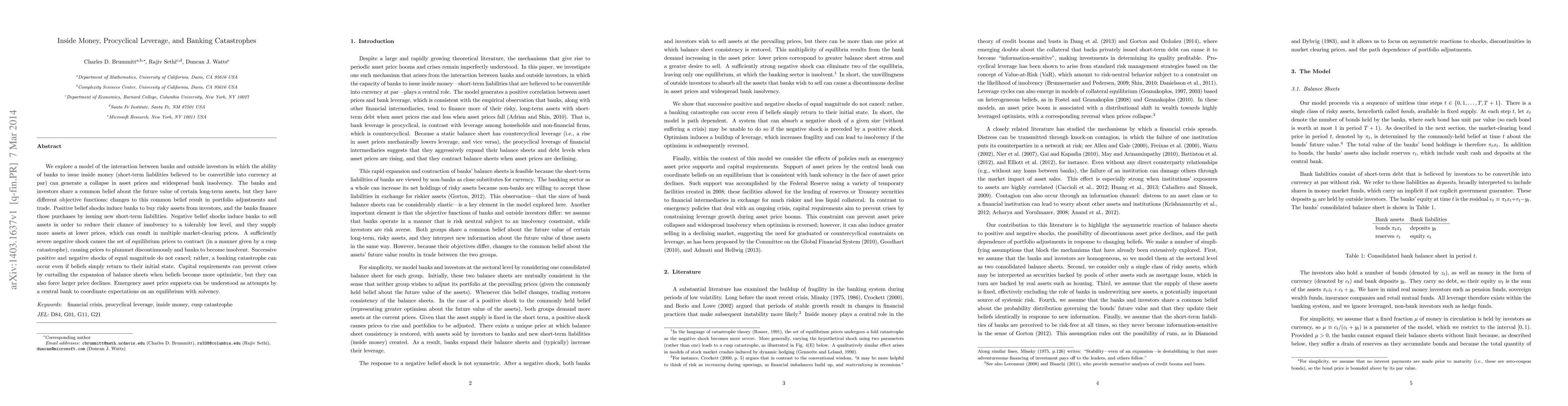

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLeverage Ratio: An empirical study of the European banking system

Siddhartha P. Chakrabarty, Kartikeya Singh, Jatin Dhingra

| Title | Authors | Year | Actions |

|---|

Comments (0)