Summary

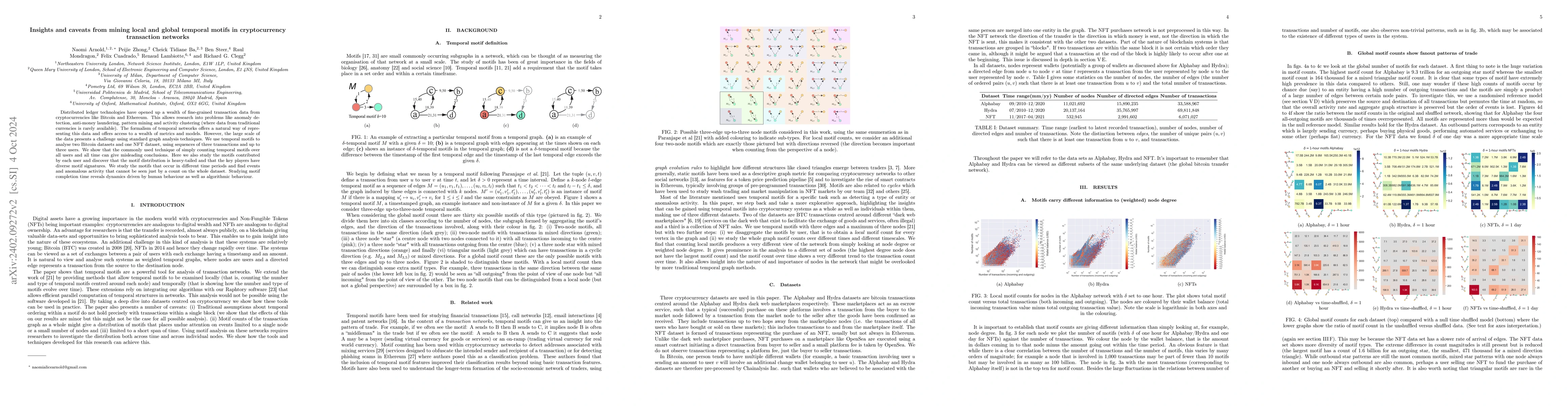

Distributed ledger technologies have opened up a wealth of fine-grained transaction data from cryptocurrencies like Bitcoin and Ethereum. This allows research into problems like anomaly detection, anti-money laundering, pattern mining and activity clustering (where data from traditional currencies is rarely available). The formalism of temporal networks offers a natural way of representing this data and offers access to a wealth of metrics and models. However, the large scale of the data presents a challenge using standard graph analysis techniques. We use temporal motifs to analyse two Bitcoin datasets and one NFT dataset, using sequences of three transactions and up to three users. We show that the commonly used technique of simply counting temporal motifs over all users and all time can give misleading conclusions. Here we also study the motifs contributed by each user and discover that the motif distribution is heavy-tailed and that the key players have diverse motif signatures. We study the motifs that occur in different time periods and find events and anomalous activity that cannot be seen just by a count on the whole dataset. Studying motif completion time reveals dynamics driven by human behaviour as well as algorithmic behaviour.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTemporal-Aware Graph Attention Network for Cryptocurrency Transaction Fraud Detection

Zhi Zheng, Bochuan Zhou, Yuping Song

Detecting Mixing Services via Mining Bitcoin Transaction Network with Hybrid Motifs

Yan Zhang, Zibin Zheng, Jiajing Wu et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)