Authors

Summary

Indirect reciprocity is a plausible mechanism for sustaining cooperation: people cooperate with those who have a good reputation, which can be acquired by helping others. However, this mechanism requires the population to agree on who has good or bad moral standing. Consensus can be provided by a central institution that monitors and broadcasts reputations. But how might such an institution be maintained, and how can a population ensure that it is effective and incorruptible? Here we explore a simple mechanism to sustain an institution of reputational judgment: a compulsory contribution from each member of the population, i.e., a tax. We analyze the maximum possible tax rate that individuals will rationally pay to sustain an institution of judgment, which provides a public good in the form of information, and we derive necessary conditions for individuals to resist the temptation to evade their tax payment. We also consider the possibility that institution members may be corrupt and subject to bribery, and we analyze how often an institution must be audited to prevent bribery. Our analysis has implications for the establishment of robust public institutions that provide social information to support cooperation in large populations--and the potential negative consequences associated with wealth or income inequality.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

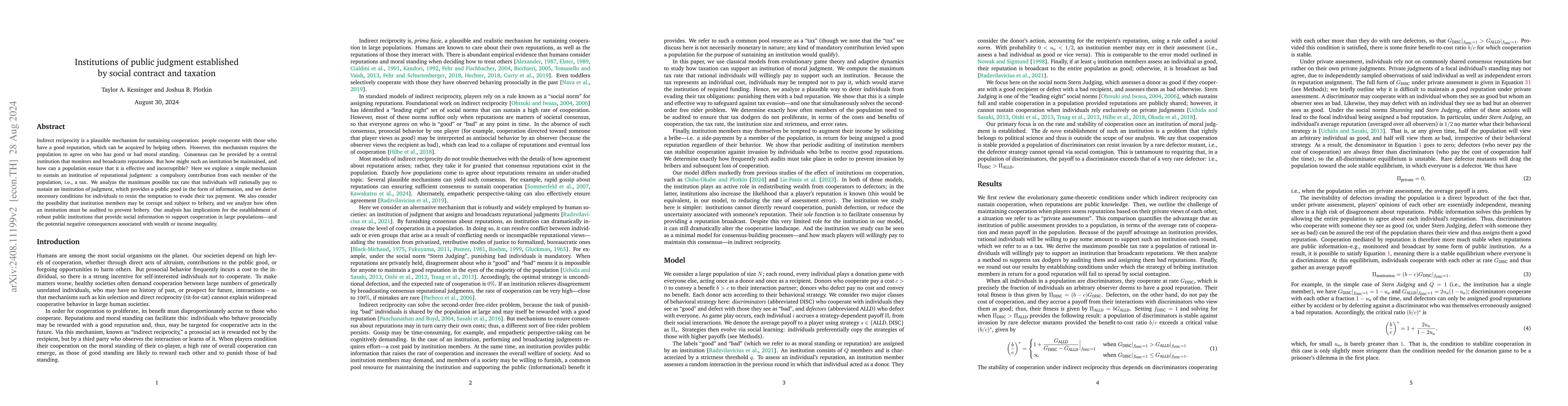

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersVariable annuities: A closer look at ratchet guarantees, hybrid contract designs, and taxation

Len Patrick Dominic M. Garces, Jennifer Alonso-Garcia, Jonathan Ziveyi

Optimal stopping contract for Public Private Partnerships under moral hazard

Caroline Hillairet, Mohamed Mnif, Ishak Hajjej

No citations found for this paper.

Comments (0)