Summary

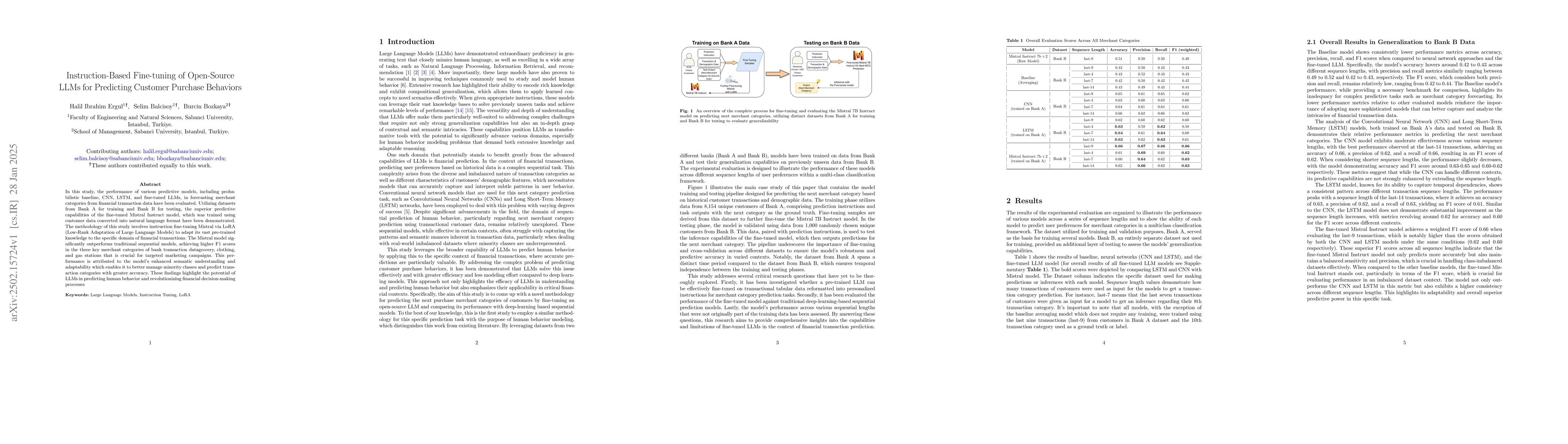

In this study, the performance of various predictive models, including probabilistic baseline, CNN, LSTM, and finetuned LLMs, in forecasting merchant categories from financial transaction data have been evaluated. Utilizing datasets from Bank A for training and Bank B for testing, the superior predictive capabilities of the fine-tuned Mistral Instruct model, which was trained using customer data converted into natural language format have been demonstrated. The methodology of this study involves instruction fine-tuning Mistral via LoRA (LowRank Adaptation of Large Language Models) to adapt its vast pre-trained knowledge to the specific domain of financial transactions. The Mistral model significantly outperforms traditional sequential models, achieving higher F1 scores in the three key merchant categories of bank transaction data (grocery, clothing, and gas stations) that is crucial for targeted marketing campaigns. This performance is attributed to the model's enhanced semantic understanding and adaptability which enables it to better manage minority classes and predict transaction categories with greater accuracy. These findings highlight the potential of LLMs in predicting human behavior.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBe Careful When Fine-tuning On Open-Source LLMs: Your Fine-tuning Data Could Be Secretly Stolen!

Shiyao Cui, Minlie Huang, Hongning Wang et al.

Private LoRA Fine-tuning of Open-Source LLMs with Homomorphic Encryption

Jordan Frery, Roman Bredehoft, Andrei Stoian et al.

GrammarGPT: Exploring Open-Source LLMs for Native Chinese Grammatical Error Correction with Supervised Fine-Tuning

Haizhou Li, Peifeng Li, Feng Jiang et al.

Open-Source LLMs for Text Annotation: A Practical Guide for Model Setting and Fine-Tuning

Meysam Alizadeh, Maël Kubli, Zeynab Samei et al.

No citations found for this paper.

Comments (0)