Summary

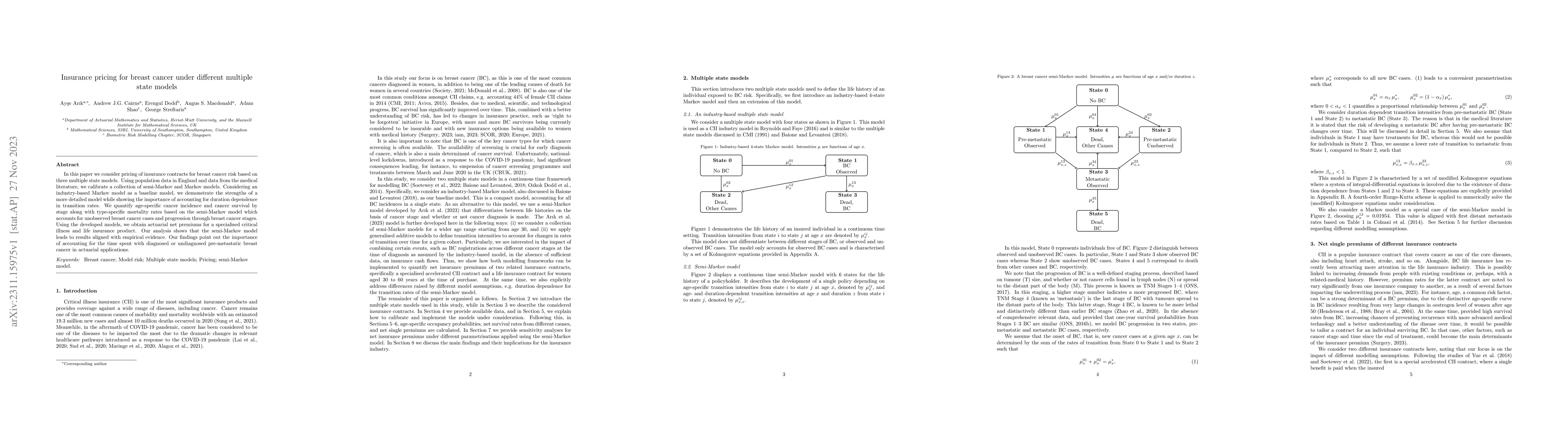

In this paper we consider pricing of insurance contracts for breast cancer risk based on three multiple state models. Using population data in England and data from the medical literature, we calibrate a collection of semi-Markov and Markov models. Considering an industry-based Markov model as a baseline model, we demonstrate the strengths of a more detailed model while showing the importance of accounting for duration dependence in transition rates. We quantify age-specific cancer incidence and cancer survival by stage along with type-specific mortality rates based on the semi-Markov model which accounts for unobserved breast cancer cases and progression through breast cancer stages. Using the developed models, we obtain actuarial net premiums for a specialised critical illness and life insurance product. Our analysis shows that the semi-Markov model leads to results aligned with empirical evidence. Our findings point out the importance of accounting for the time spent with diagnosed or undiagnosed pre-metastatic breast cancer in actuarial applications.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)