Authors

Summary

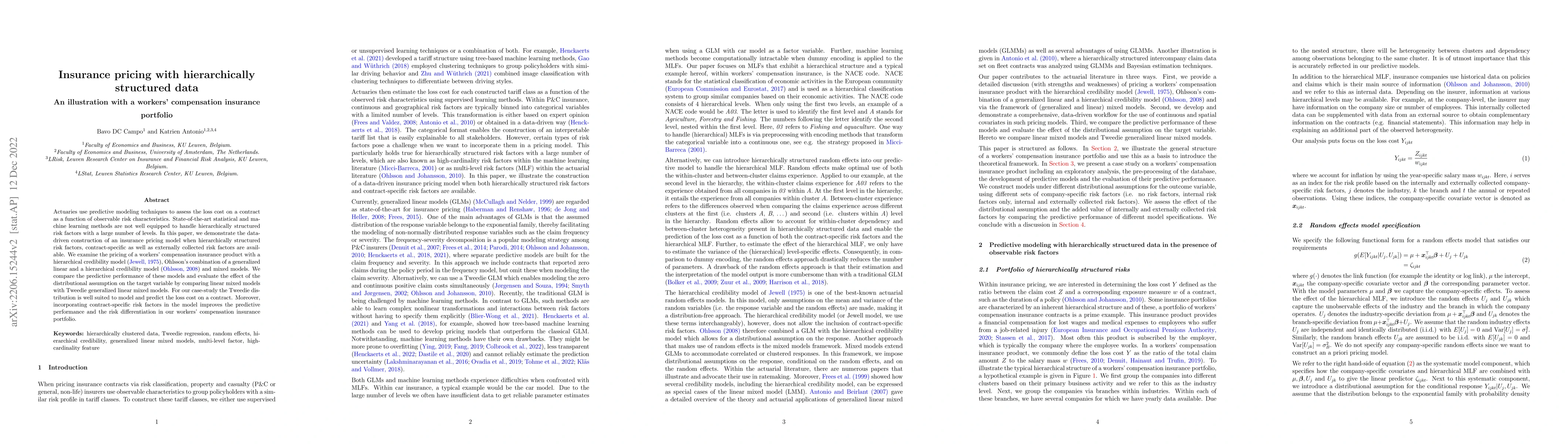

Actuaries use predictive modeling techniques to assess the loss cost on a contract as a function of observable risk characteristics. State-of-the-art statistical and machine learning methods are not well equipped to handle hierarchically structured risk factors with a large number of levels. In this paper, we demonstrate the data-driven construction of an insurance pricing model when hierarchically structured risk factors, contract-specific as well as externally collected risk factors are available. We examine the pricing of a workers' compensation insurance product with a hierarchical credibility model (Jewell, 1975), Ohlsson's combination of a generalized linear and a hierarchical credibility model (Ohlsson, 2008) and mixed models. We compare the predictive performance of these models and evaluate the effect of the distributional assumption on the target variable by comparing linear mixed models with Tweedie generalized linear mixed models. For our case-study the Tweedie distribution is well suited to model and predict the loss cost on a contract. Moreover, incorporating contract-specific risk factors in the model improves the predictive performance and the risk differentiation in our workers' compensation insurance portfolio.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDiscrimination-free Insurance Pricing with Privatized Sensitive Attributes

Peng Shi, Tianhe Zhang, Suhan Liu

A representation-learning approach for insurance pricing with images

Etienne Marceau, Luc Lamontagne, Christopher Blier-Wong

| Title | Authors | Year | Actions |

|---|

Comments (0)