Authors

Summary

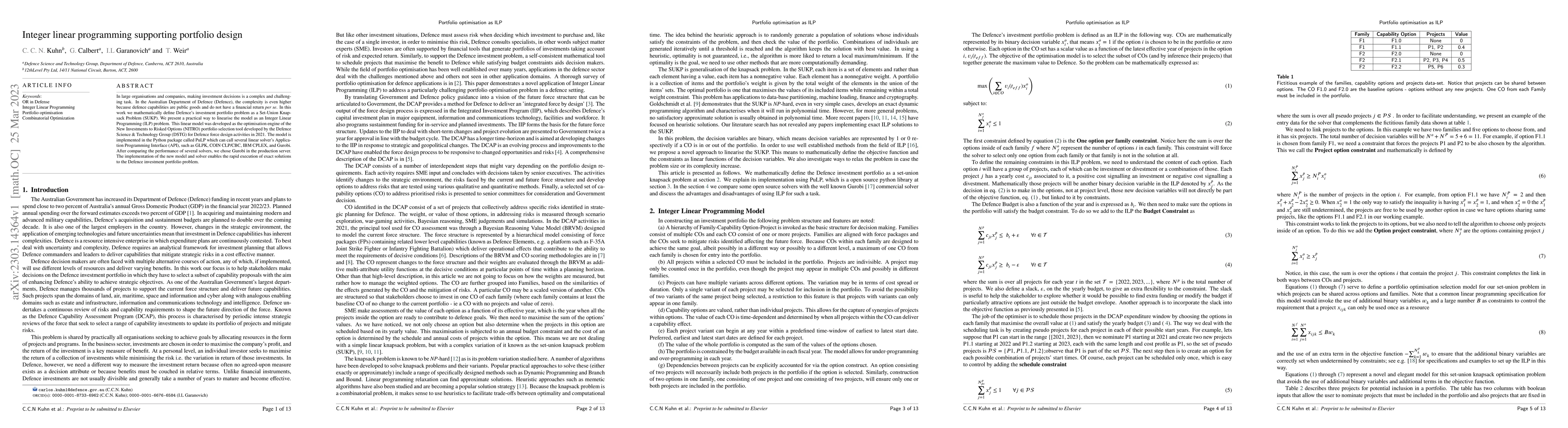

In large organisations and companies, making investment decisions is a complex and challenging task. In the Australian Department of Defence (Defence), the complexity is even higher because defence capabilities are public goods and do not have a financial return \textit{per se}. In this work we mathematically define Defence's investment portfolio problem as a Set-Union Knapsack Problem (SUKP). We present a practical way to linearise the model as an Integer Linear Programming (ILP) problem. This linear model was developed as the optimisation engine of the New Investments to Risked Options (NITRO) portfolio selection tool developed by the Defence Science \& Technology Group (DSTG) for Defence force design activities in 2021. The model is implemented in the Python package called PuLP which can call several linear solver's Application Programming Interface (API), such as GLPK, COIN CLP/CBC, IBM CPLEX, and Gurobi. After comparing the performance of several solvers, we chose Gurobi in the production server. The implementation of the new model and solver enables the rapid execution of exact solutions to the Defence investment portfolio problem.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCislunar Satellite Constellation Design Via Integer Linear Programming

Koki Ho, Hang Woon Lee, Yuri Shimane et al.

Integer Linear Programming Preprocessing for Maximum Satisfiability

Jialu Zhang, Shuolin Li, Chu-Min Li et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)