Summary

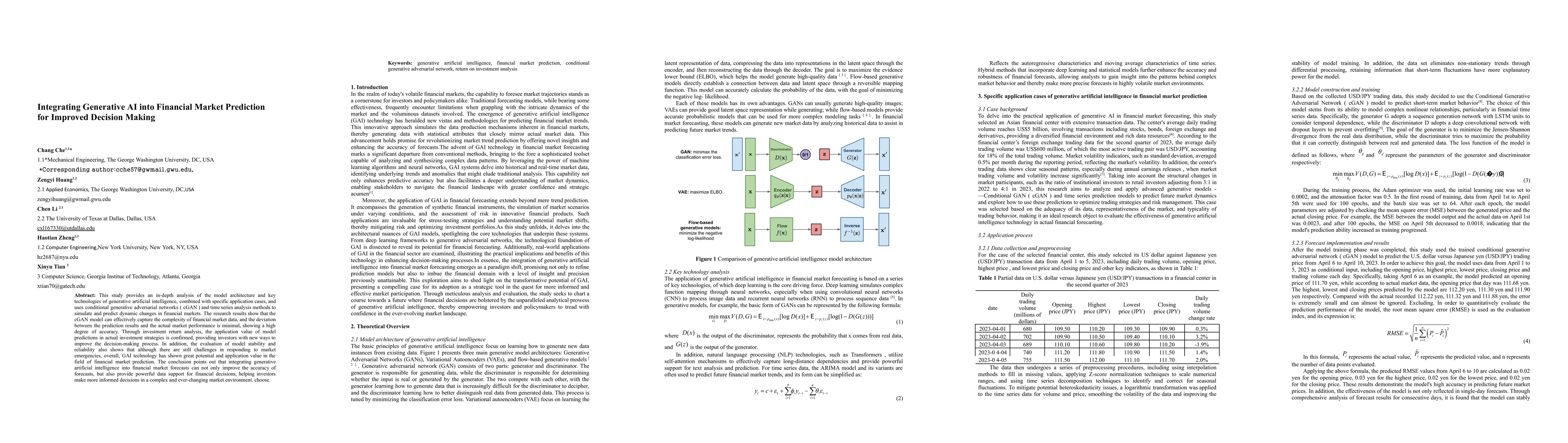

This study provides an in-depth analysis of the model architecture and key technologies of generative artificial intelligence, combined with specific application cases, and uses conditional generative adversarial networks ( cGAN ) and time series analysis methods to simulate and predict dynamic changes in financial markets. The research results show that the cGAN model can effectively capture the complexity of financial market data, and the deviation between the prediction results and the actual market performance is minimal, showing a high degree of accuracy.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersJourney of Hallucination-minimized Generative AI Solutions for Financial Decision Makers

Sohini Roychowdhury

Augmenting Human Cognition With Generative AI: Lessons From AI-Assisted Decision-Making

Zelun Tony Zhang, Leon Reicherts

A Comparison Between Human and Generative AI Decision-Making Attributes in Complex Health Services

Nandini Doreswamy, Louise Horstmanshof

Modeling News Interactions and Influence for Financial Market Prediction

Mengyu Wang, Shay B. Cohen, Tiejun Ma

| Title | Authors | Year | Actions |

|---|

Comments (0)