Summary

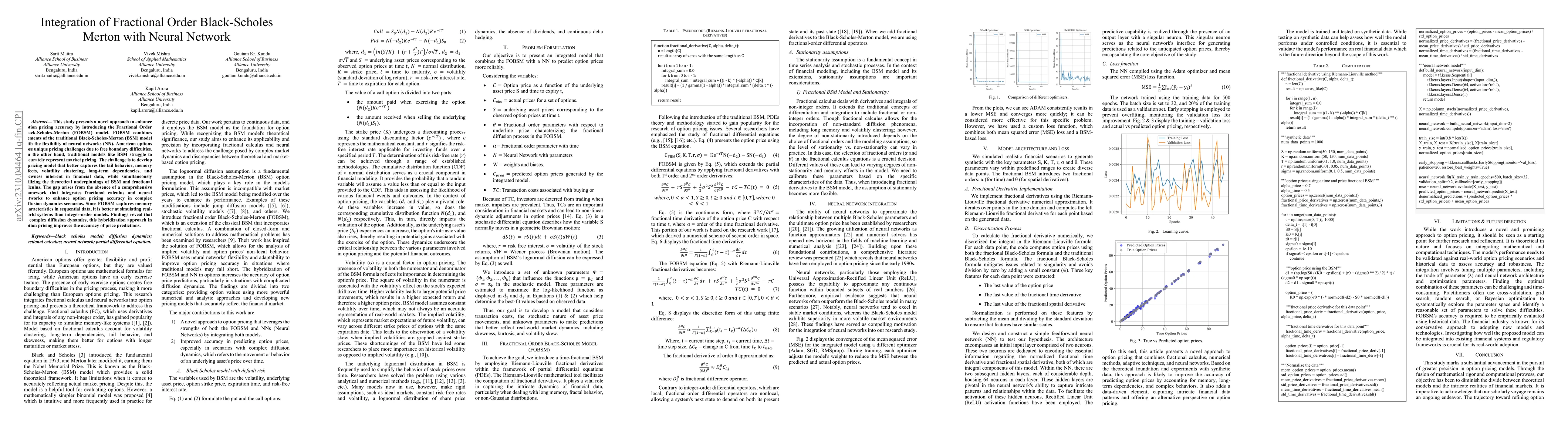

This study enhances option pricing by presenting unique pricing model fractional order Black-Scholes-Merton (FOBSM) which is based on the Black-Scholes-Merton (BSM) model. The main goal is to improve the precision and authenticity of option pricing, matching them more closely with the financial landscape. The approach integrates the strengths of both the BSM and neural network (NN) with complex diffusion dynamics. This study emphasizes the need to take fractional derivatives into account when analyzing financial market dynamics. Since FOBSM captures memory characteristics in sequential data, it is better at simulating real-world systems than integer-order models. Findings reveals that in complex diffusion dynamics, this hybridization approach in option pricing improves the accuracy of price predictions. the key contribution of this work lies in the development of a novel option pricing model (FOBSM) that leverages fractional calculus and neural networks to enhance accuracy in capturing complex diffusion dynamics and memory effects in financial data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSymmetries of the Black-Scholes-Merton equation for European options

Landysh N. Bakirova, Marina A. Shurygina, Vadim V. Shurygin, Jr

Black-Scholes-Merton Option Pricing Revisited: Did we Find a Fatal Flaw?

Mark Mink, Frans J. de Weert

| Title | Authors | Year | Actions |

|---|

Comments (0)