Authors

Summary

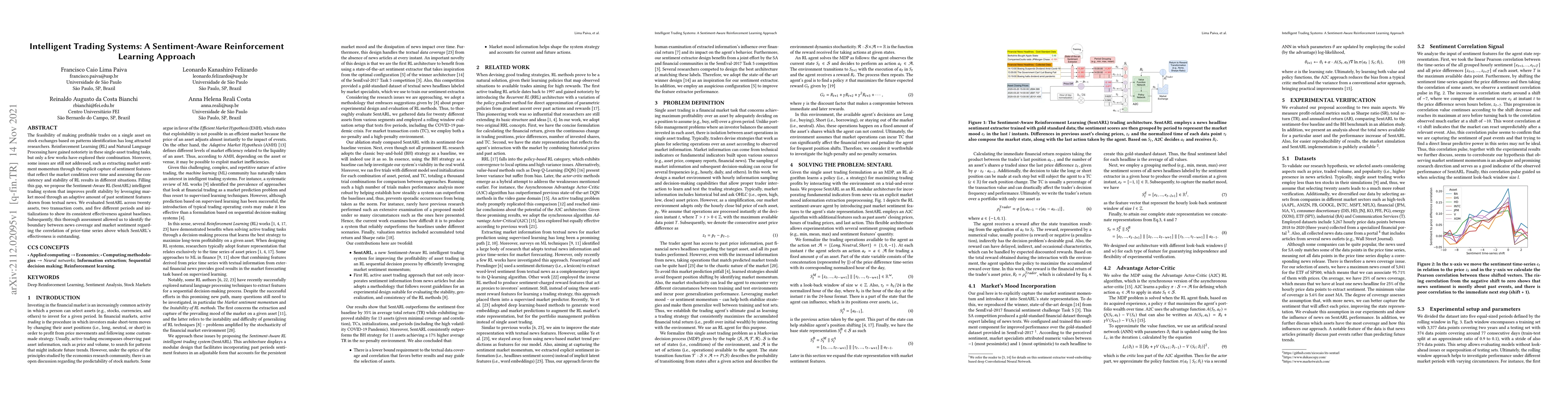

The feasibility of making profitable trades on a single asset on stock exchanges based on patterns identification has long attracted researchers. Reinforcement Learning (RL) and Natural Language Processing have gained notoriety in these single-asset trading tasks, but only a few works have explored their combination. Moreover, some issues are still not addressed, such as extracting market sentiment momentum through the explicit capture of sentiment features that reflect the market condition over time and assessing the consistency and stability of RL results in different situations. Filling this gap, we propose the Sentiment-Aware RL (SentARL) intelligent trading system that improves profit stability by leveraging market mood through an adaptive amount of past sentiment features drawn from textual news. We evaluated SentARL across twenty assets, two transaction costs, and five different periods and initializations to show its consistent effectiveness against baselines. Subsequently, this thorough assessment allowed us to identify the boundary between news coverage and market sentiment regarding the correlation of price-time series above which SentARL's effectiveness is outstanding.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)