Authors

Summary

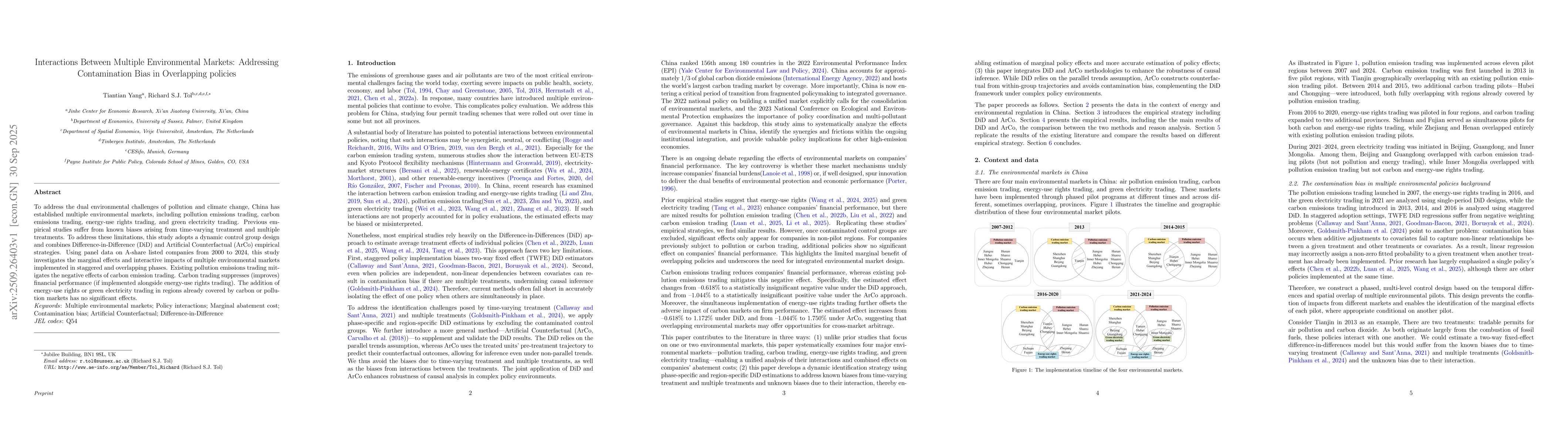

To address the dual environmental challenges of pollution and climate change, China has established multiple environmental markets, including pollution emissions trading, carbon emissions trading, energy-use rights trading, and green electricity trading. Previous empirical studies suffer from known biases arising from time-varying treatment and multiple treatments. To address these limitations, this study adopts a dynamic control group design and combines Difference-in-Difference (DiD) and Artificial Counterfactual (ArCo) empirical strategies. Using panel data on A-share listed companies from 2000 to 2024, this study investigates the marginal effects and interactive impacts of multiple environmental markets implemented in staggered and overlapping phases. Existing pollution emissions trading mitigates the negative effects of carbon emission trading. Carbon trading suppresses (improves) financial performance (if implemented alongside energy-use rights trading). The addition of energy-use rights or green electricity trading in regions already covered by carbon or pollution markets has no significant effects.

AI Key Findings

Generated Oct 01, 2025

Methodology

The study employs a difference-in-differences (DiD) approach combined with an artificial counterfactual (ArCo) method to analyze the impact of overlapping environmental policies on firm performance. It uses panel data from China's carbon emission trading, energy-use permit trading, and green electricity trading systems.

Key Results

- Carbon emission trading reduces firms' return on assets by approximately 0.618% under DiD and 1.044% under ArCo.

- Existing pollution emission trading mitigates the negative impact of carbon market policies, making the effect statistically insignificant.

- Simultaneous implementation of energy-use permit trading further offsets adverse impacts of carbon markets on firm performance.

Significance

This research provides critical insights into the effectiveness of overlapping environmental policies, informing policymakers about optimal policy combinations to balance environmental goals with economic impacts.

Technical Contribution

The study advances policy evaluation methods by combining DiD with ArCo, providing a more robust framework for analyzing complex policy interactions in high-dimensional panel data.

Novelty

This work is novel in its comprehensive analysis of overlapping environmental market policies and their combined impacts on firm performance, offering new insights into policy synergies and trade-offs.

Limitations

- Relies on proxy variables for treatment assignment (province/industry) rather than firm-level regulation data

- Does not account for intra-firm reallocation responses to regulation

Future Work

- Develop more granular firm-level regulatory data collection methods

- Investigate dynamic interactions between multiple policy instruments over time

- Examine heterogeneous impacts across different industry sectors

Paper Details

PDF Preview

Similar Papers

Found 4 papersContamination Bias in Linear Regressions

Paul Goldsmith-Pinkham, Peter Hull, Michal Kolesár

Comments (0)