Summary

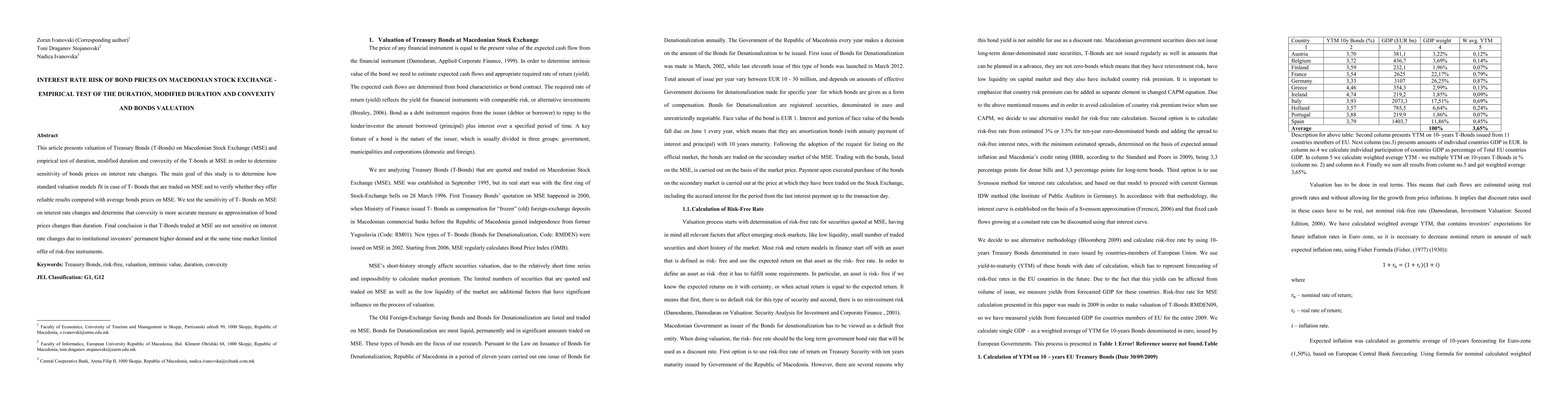

This article presents valuation of Treasury Bonds (T-Bonds) on Macedonian Stock Exchange (MSE) and empirical test of duration, modified duration and convexity of the T-bonds at MSE in order to determine sensitivity of bonds prices on interest rate changes. The main goal of this study is to determine how standard valuation models fit in case of T- Bonds that are traded on MSE and to verify whether they offer reliable results compared with average bonds prices on MSE. We test the sensitivity of T- Bonds on MSE on interest rate changes and determine that convexity is more accurate measure as approximation of bond prices changes than duration. Final conclusion is that T-Bonds traded at MSE are not sensitive on interest rate changes due to institutional investors' permanent higher demand and at the same time market limited offer of risk-free instruments.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)