Authors

Summary

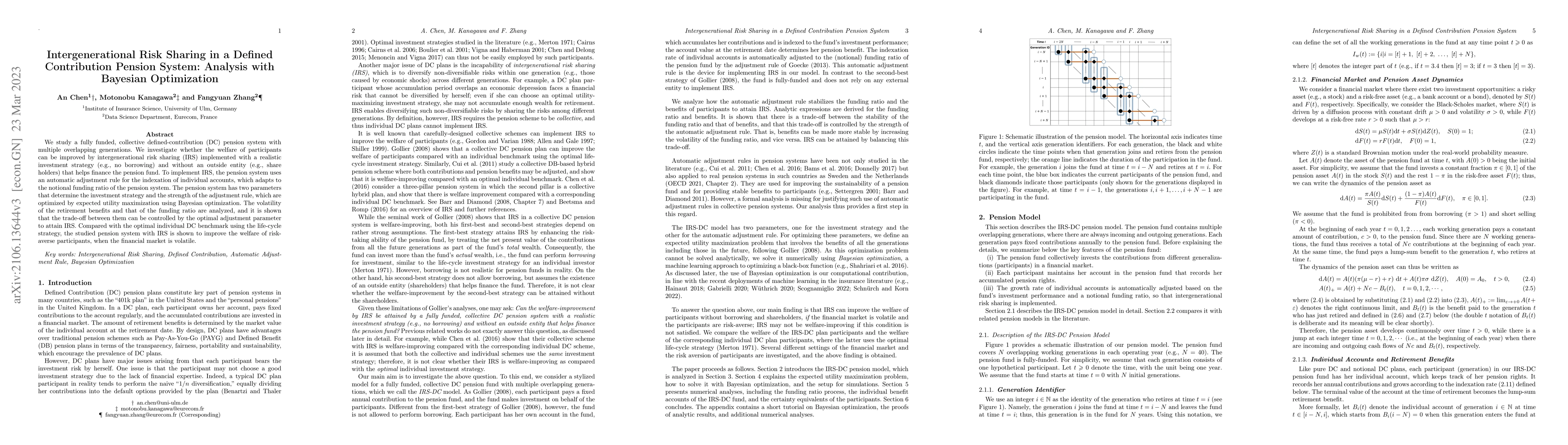

We study a fully funded, collective defined-contribution (DC) pension system with multiple overlapping generations. We investigate whether the welfare of participants can be improved by intergenerational risk sharing (IRS) implemented with a realistic investment strategy (e.g., no borrowing) and without an outside entity (e.g., share holders) that helps finance the pension fund. To implement IRS, the pension system uses an automatic adjustment rule for the indexation of individual accounts, which adapts to the notional funding ratio of the pension system. The pension system has two parameters that determine the investment strategy and the strength of the adjustment rule, which are optimized by expected utility maximization using Bayesian optimization. The volatility of the retirement benefits and that of the funding ratio are analyzed, and it is shown that the trade-off between them can be controlled by the optimal adjustment parameter to attain IRS. Compared with the optimal individual DC benchmark using the life-cycle strategy, the studied pension system with IRS is shown to improve the welfare of risk-averse participants, when the financial market is volatile.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)