Authors

Summary

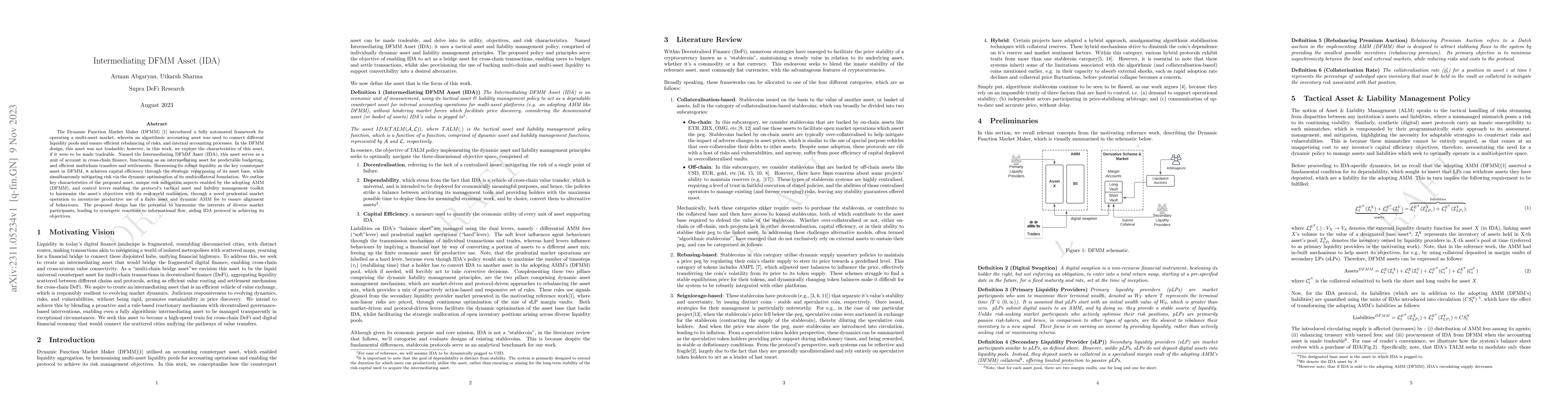

The Dynamic Function Market Maker (DFMM) introduced a fully automated framework for operating a multi-asset market, wherein an algorithmic accounting asset was used to connect different liquidity pools and ensure efficient rebalancing of risks, and internal accounting processes. In the DFMM design, this asset was not tradaeble; however, in this work, we explore the characteristics of this asset, if it were to be made tradeable. Named the Intermediating DFMM Asset (IDA), this asset serves as a unit of account in cross-chain finance, functioning as an intermediating asset for predictable budgeting, and efficient multichain transfers and settlements. Harnessing its robust liquidity as the key counterpart asset in DFMM, it achieves capital efficiency through the strategic repurposing of its asset base, while simultaneously mitigating risk via the dynamic optimisation of its multicollateral foundation. We outline key characteristics of the proposed asset, unique risk mitigation aspects enabled by the adopting AMM (DFMM), and control levers enabling the protocol's tactical asset and liability management toolkit to harmonise the asset's objectives with its real-world realisation, through a novel prudential market operation to incentivise productive use of a finite asset and dynamic AMM fee to ensure alignment of behaviours. The proposed design has the potential to harmonise the interests of diverse market participants, leading to synergetic reactions to informational flow, aiding IDA protocol in achieving its objectives.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersShared Autonomy with IDA: Interventional Diffusion Assistance

Bolei Zhou, Zhenghao Peng, Jonathan C. Kao et al.

Robust Neural IDA-PBC: passivity-based stabilization under approximations

Bayu Jayawardhana, Samuele Zoboli, Santiago Sanchez-Escalonilla

No citations found for this paper.

Comments (0)