Authors

Summary

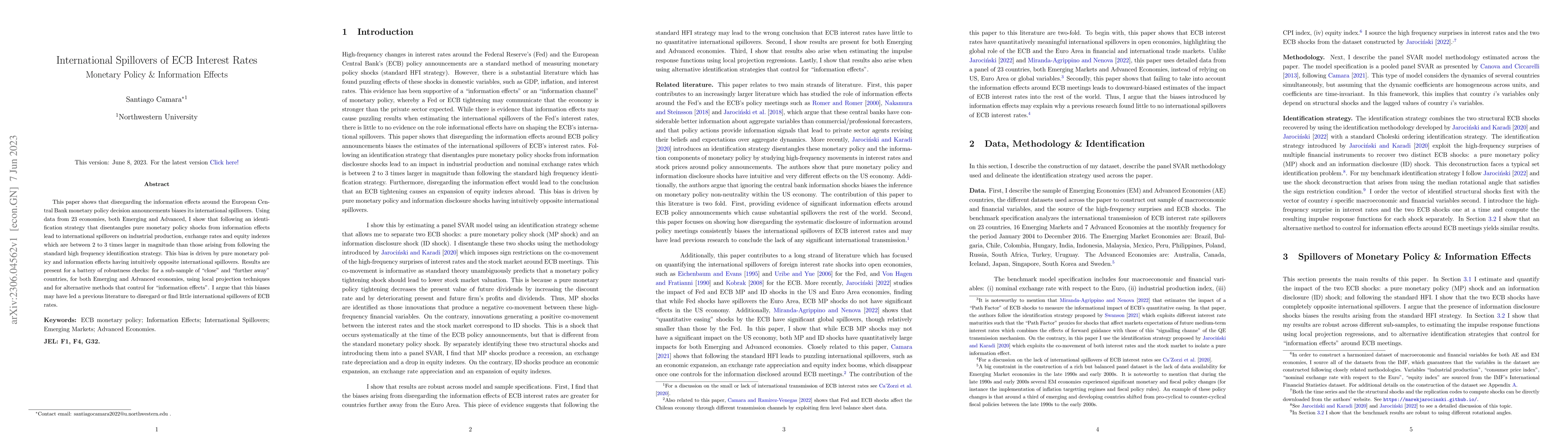

This paper shows that disregarding the information effects around the European Central Bank monetary policy decision announcements biases its international spillovers. Using data from 23 economies, both Emerging and Advanced, I show that following an identification strategy that disentangles pure monetary policy shocks from information effects lead to international spillovers on industrial production, exchange rates and equity indexes which are between 2 to 3 times larger in magnitude than those arising from following the standard high frequency identification strategy. This bias is driven by pure monetary policy and information effects having intuitively opposite international spillovers. Results are present for a battery of robustness checks: for a sub-sample of ``close'' and ``further away'' countries, for both Emerging and Advanced economies, using local projection techniques and for alternative methods that control for ``information effects''. I argue that this biases may have led a previous literature to disregard or find little international spillovers of ECB rates.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)