Authors

Summary

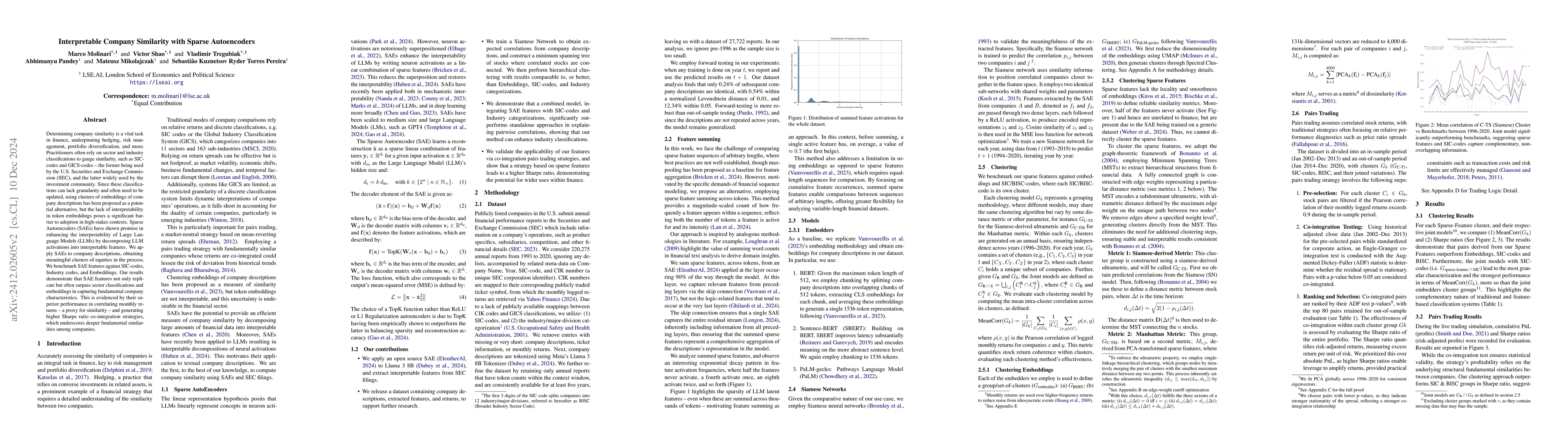

Determining company similarity is a vital task in finance, underpinning hedging, risk management, portfolio diversification, and more. Practitioners often rely on sector and industry classifications to gauge similarity, such as SIC-codes and GICS-codes, the former being used by the U.S. Securities and Exchange Commission (SEC), and the latter widely used by the investment community. Clustering embeddings of company descriptions has been proposed as a potential technique for determining company similarity, but the lack of interpretability in token embeddings poses a significant barrier to adoption in high-stakes contexts. Sparse Autoencoders have shown promise in enhancing the interpretability of Large Language Models by decomposing LLM activations into interpretable features. In this paper, we explore the use of SAE features in measuring company similarity and benchmark them against (1) SIC codes and (2) Major Group codes. We conclude that SAE features can reproduce and even surpass sector classifications in quantifying fundamental characteristics of companies, evaluated by the correlation of monthly returns, a proxy for similarity, and PnL from cointegration.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersTIDE : Temporal-Aware Sparse Autoencoders for Interpretable Diffusion Transformers in Image Generation

Le Zhuo, Hongsheng Li, Peng Gao et al.

Universal Sparse Autoencoders: Interpretable Cross-Model Concept Alignment

Thomas Fel, Matthew Kowal, Harrish Thasarathan et al.

SAeUron: Interpretable Concept Unlearning in Diffusion Models with Sparse Autoencoders

Kamil Deja, Bartosz Cywiński

No citations found for this paper.

Comments (0)