Authors

Summary

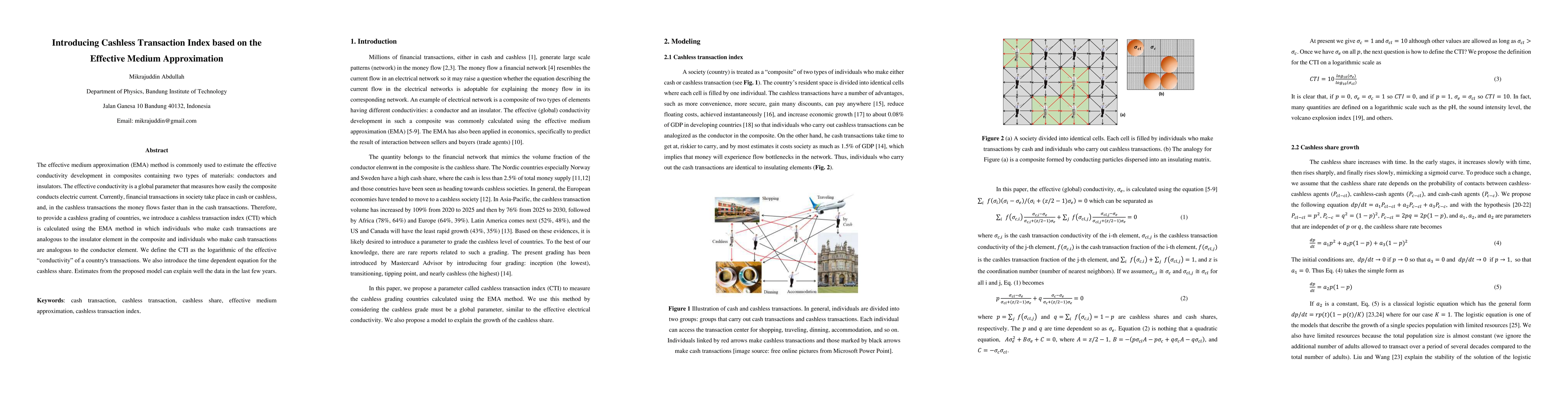

The effective medium approximation (EMA) method is commonly used to estimate the effective conductivity development in composites containing two types of materials: conductors and insulators. The effective conductivity is a global parameter that measures how easily the composite conducts electric current. Currently, financial transactions in society take place in cash or cashless, and, in the cashless transactions the money flows faster than in the cash transactions. Therefore, to provide a cashless grading of countries, we introduce a cashless transaction index (CTI) which is calculated using the EMA method in which individuals who make cash transactions are analogous to the insulator element in the composite and individuals who make cash transactions are analogous to the conductor element. We define the CTI as the logarithmic of the effective conductivity of a country's transactions. We also introduce the time dependent equation for the cashless share. Estimates from the proposed model can explain well the data in the last few years.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)