Summary

We investigate the problem of inferring the causal predictors of a response $Y$ from a set of $d$ explanatory variables $(X^1,\dots,X^d)$. Classical ordinary least squares regression includes all predictors that reduce the variance of $Y$. Using only the causal predictors instead leads to models that have the advantage of remaining invariant under interventions, loosely speaking they lead to invariance across different "environments" or "heterogeneity patterns". More precisely, the conditional distribution of $Y$ given its causal predictors remains invariant for all observations. Recent work exploits such a stability to infer causal relations from data with different but known environments. We show that even without having knowledge of the environments or heterogeneity pattern, inferring causal relations is possible for time-ordered (or any other type of sequentially ordered) data. In particular, this allows detecting instantaneous causal relations in multivariate linear time series which is usually not the case for Granger causality. Besides novel methodology, we provide statistical confidence bounds and asymptotic detection results for inferring causal predictors, and present an application to monetary policy in macroeconomics.

AI Key Findings - Failed

Key findings generation failed. Failed to start generation process

Paper Details

PDF Preview

Key Terms

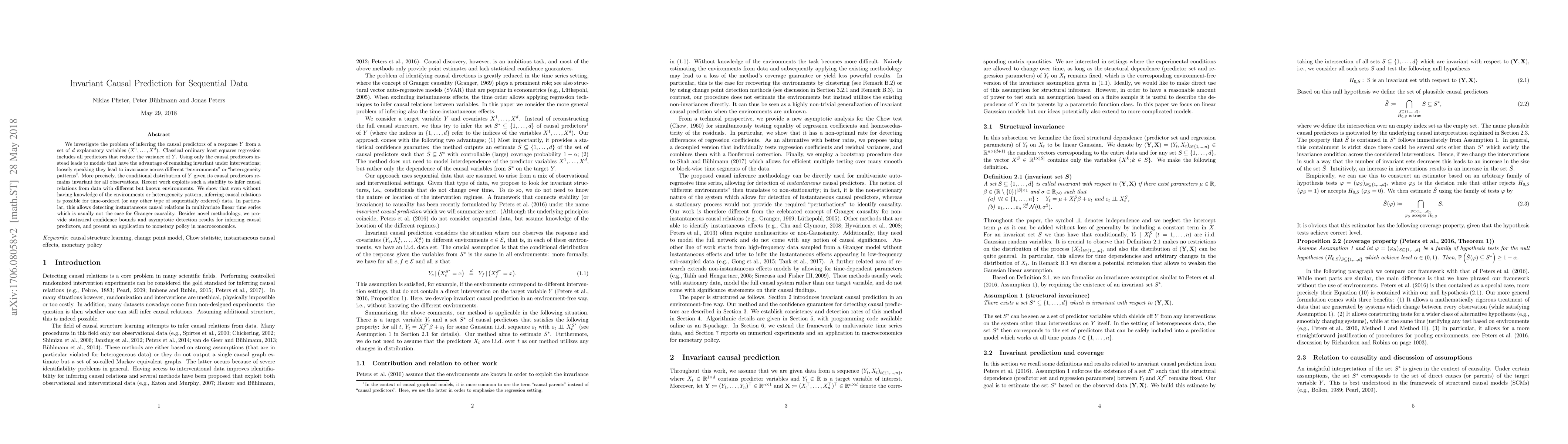

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)