Summary

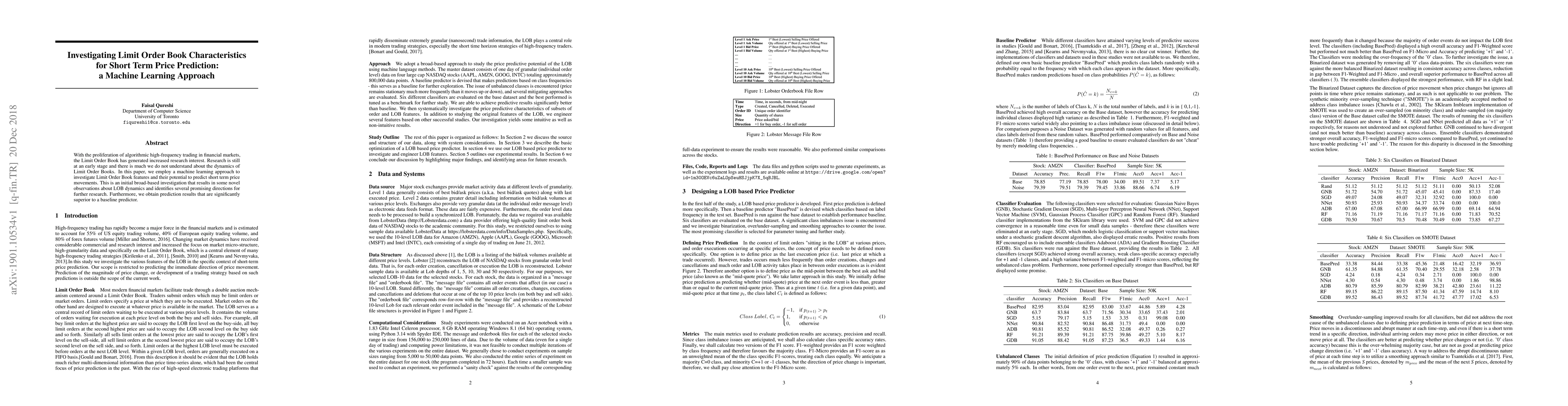

With the proliferation of algorithmic high-frequency trading in financial markets, the Limit Order Book has generated increased research interest. Research is still at an early stage and there is much we do not understand about the dynamics of Limit Order Books. In this paper, we employ a machine learning approach to investigate Limit Order Book features and their potential to predict short term price movements. This is an initial broad-based investigation that results in some novel observations about LOB dynamics and identifies several promising directions for further research. Furthermore, we obtain prediction results that are significantly superior to a baseline predictor.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)