Authors

Summary

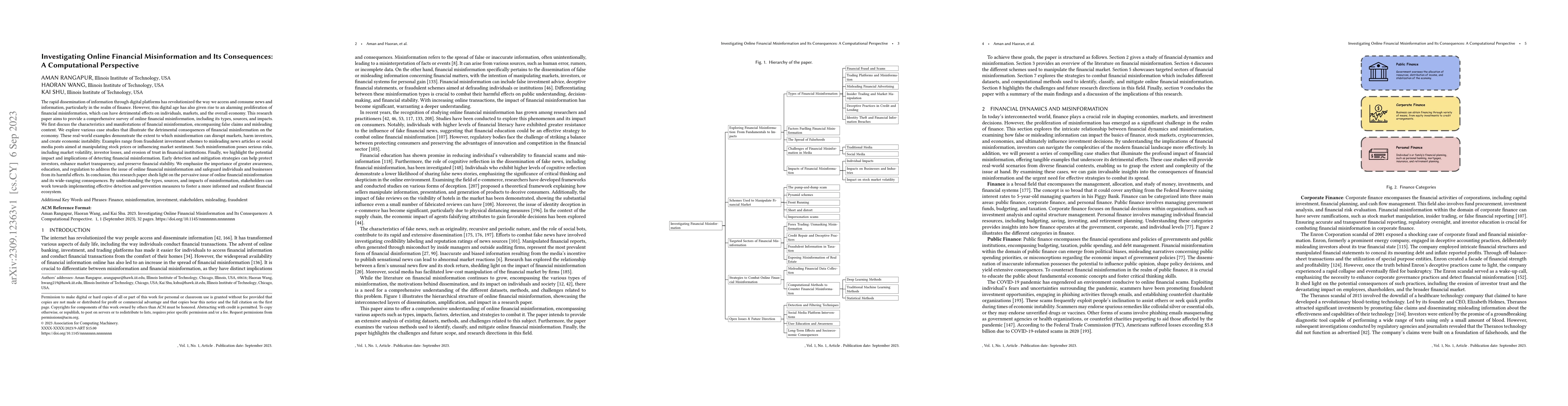

The rapid dissemination of information through digital platforms has revolutionized the way we access and consume news and information, particularly in the realm of finance. However, this digital age has also given rise to an alarming proliferation of financial misinformation, which can have detrimental effects on individuals, markets, and the overall economy. This research paper aims to provide a comprehensive survey of online financial misinformation, including its types, sources, and impacts. We first discuss the characteristics and manifestations of financial misinformation, encompassing false claims and misleading content. We explore various case studies that illustrate the detrimental consequences of financial misinformation on the economy. Finally, we highlight the potential impact and implications of detecting financial misinformation. Early detection and mitigation strategies can help protect investors, enhance market transparency, and preserve financial stability. We emphasize the importance of greater awareness, education, and regulation to address the issue of online financial misinformation and safeguard individuals and businesses from its harmful effects. In conclusion, this research paper sheds light on the pervasive issue of online financial misinformation and its wide-ranging consequences. By understanding the types, sources, and impacts of misinformation, stakeholders can work towards implementing effective detection and prevention measures to foster a more informed and resilient financial ecosystem.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMisinformation with Legal Consequences (MisLC): A New Task Towards Harnessing Societal Harm of Misinformation

Xiaodan Zhu, Chu Fei Luo, Rohan Bhambhoria et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)