Summary

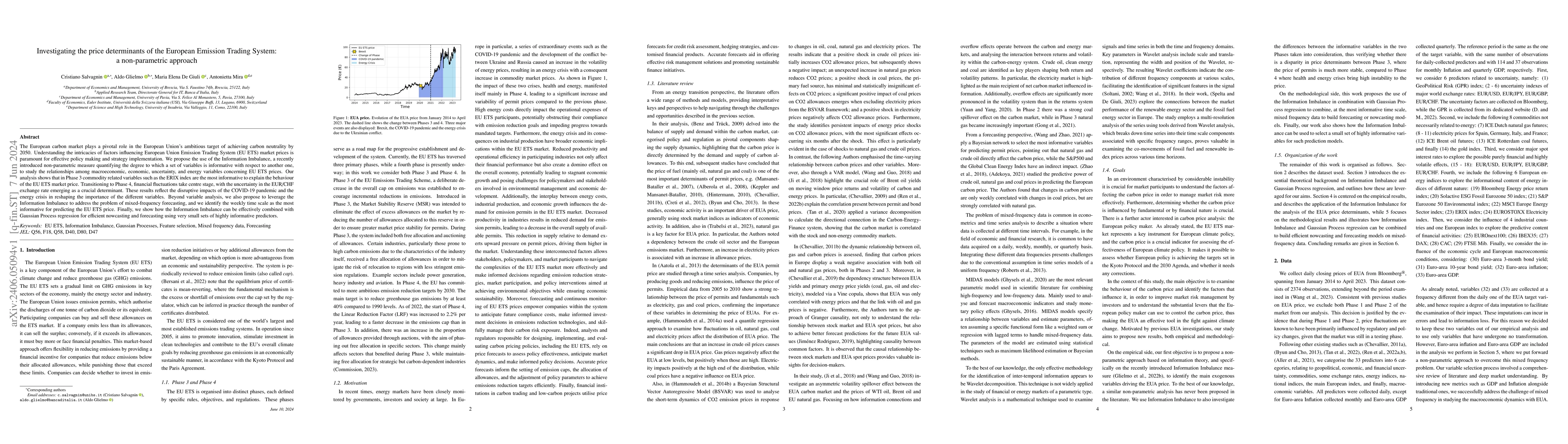

The European carbon market plays a pivotal role in the European Union's ambitious target of achieving carbon neutrality by 2050. Understanding the intricacies of factors influencing European Union Emission Trading System (EU ETS) market prices is paramount for effective policy making and strategy implementation. We propose the use of the Information Imbalance, a recently introduced non-parametric measure quantifying the degree to which a set of variables is informative with respect to another one, to study the relationships among macroeconomic, economic, uncertainty, and energy variables concerning EU ETS prices. Our analysis shows that in Phase 3 commodity related variables such as the ERIX index are the most informative to explain the behaviour of the EU ETS market price. Transitioning to Phase 4, financial fluctuations take centre stage, with the uncertainty in the EUR/CHF exchange rate emerging as a crucial determinant. These results reflect the disruptive impacts of the COVID-19 pandemic and the energy crisis in reshaping the importance of the different variables. Beyond variable analysis, we also propose to leverage the Information Imbalance to address the problem of mixed-frequency forecasting, and we identify the weekly time scale as the most informative for predicting the EU ETS price. Finally, we show how the Information Imbalance can be effectively combined with Gaussian Process regression for efficient nowcasting and forecasting using very small sets of highly informative predictors.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA non-parametric approach for estimating consumer valuation distributions using second price auctions

Sourav Mukherjee, Kshitij Khare, Rohit K Patra

| Title | Authors | Year | Actions |

|---|

Comments (0)